10K Swap – DEX & AMM Platform Review

Vision and Purpose

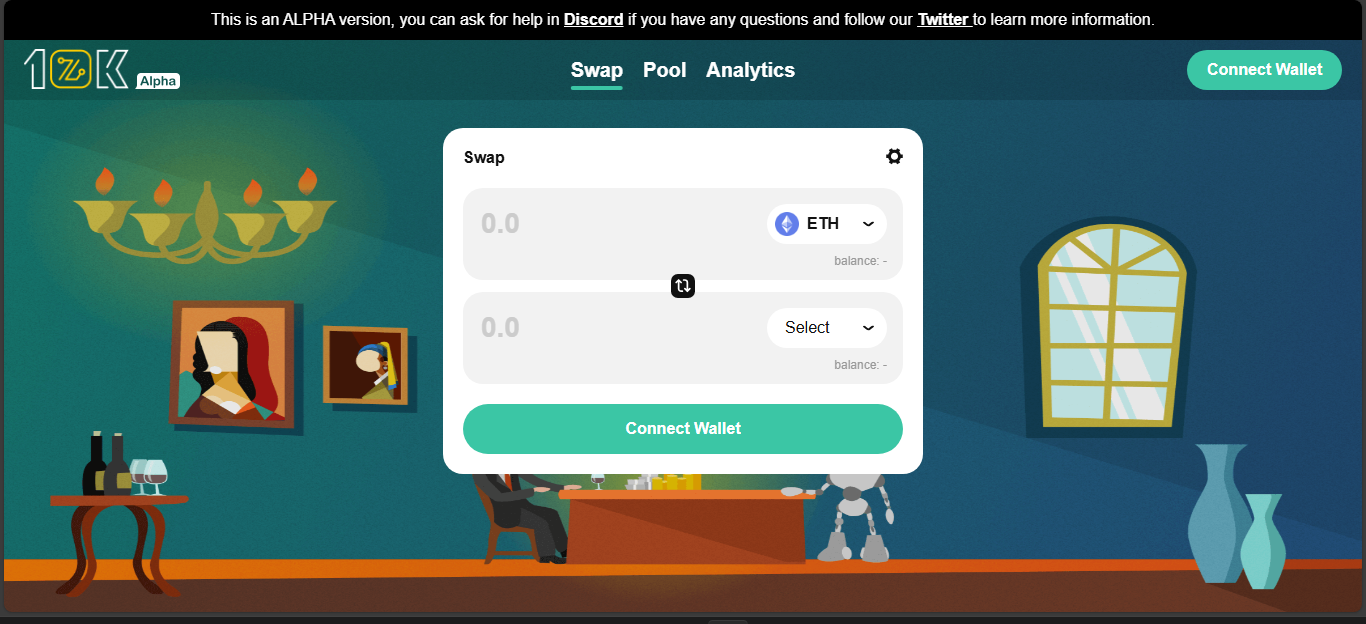

10K Swap takes aim at the heart of DeFi friction – Ethereum gas and sluggish execution – by unfolding on Starknet, a Layer 2 rollup. It touts itself as the first fully open-source AMM on that network, designed to reduce transaction costs and iron out liquidity lag. In a sense, it’s DeFi distilled for efficiency.

Under the Hood

The engine of 10K Swap is a classic automated market maker, but anchored in Starknet’s rollup architecture. That means cheaper transactions, faster execution, and potentially cleaner liquidity curves. Beyond simple swapping, it offers pooling services and even participation in Starknet’s DeFi Spring incentives, where users can earn STRK tokens by providing liquidity.

Markets & Assets

Despite its promise, 10K Swap plays in a compact field. It supports mainstay tokens like ETH, USDC, DAI, USDT, WBTC and STRK. That’s a solid core but not vast. For curious DeFi users, it’s enough to explore liquidity and yield on Starknet, but not a destination for exotic pairs.

Volume & Activity

On surface-level metrics, 10K Swap registers minimal trading activity – volumes hover in the low tens of thousands of dollars daily, with negligible BTC volume detected. That signals proximity to niche utility rather than bustling trade lanes. It’s more experimental playground than bustling marketplace.

Decentralization & Accessibility

10K Swap leans fully into DeFi ethos – non-custodial, open-source, and peer-to-peer. Rollup backend keeps fees low, and the interface taps directly into user wallets. That fluidity aligns with decentralized values, though comfort level hinges on users’ Starknet familiarity.

Weak Spots & Unknowns

Here’s where caution rides shotgun: the project is unregulated, with no licensing or formal oversight. Support channels are limited – expect community-driven Discord or X presence, but not 24/7 help desks. Token incentives are enticing, but unclear emission schedules and tokenomics raise questions.

Strengths & Weaknesses Snapshot

Strengths:

- Low-cost swaps powered by Starknet rollup

- Fully open-source, DeFi-aligned protocols

- Participation in ecosystem incentives like DeFi Spring

- Accessible core assets useful for Starknet-focused users

Weaknesses:

- Thin trading activity and limited pair options

- Unregulated framework and scant support infrastructure

- Tokenomics and incentive clarity remain murky

- Niche appeal – less compelling for broader DeFi traders

Conclusion

10K Swap unfolds as a nimble experiment in DeFi architecture. It’s lean and efficient, riding Starknet to trim costs and layer composability into AMM design. For DeFi tinkerers and Starknet loyalists, it offers real substance – low fees, open code, ecosystem incentives.

But if you’re chasing volume, variety, or polished operations, it may feel sparse. 10K Swap isn’t chasing dominance – it’s carving space as an efficient niche. The question is what you value: bleeding-edge simplicity, or breadth of ladder to trade on.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”