ALEX- Exchange Review

ALEX steps up as the first truly integrated DeFi platform built on Bitcoin via the Stacks layer – packing lending, borrowing, swaps, launchpad and yield farming into a single ecosystem.

Built Around Bitcoin, Powered by Stacks

ALEX stands out by bringing DeFi to Bitcoin through Stacks smart contracts. It’s open-source and blends automated liquidity exchange with fixed-term, fixed-rate borrowing and lending – all without risking liquidation. Diversified lending pools mix risky and safe assets, balanced algorithmically. The model leans on traditional financial theory (think Black-Scholes) but remains fully on-chain – DeFi with financial rigor.

Lending, Swaps, Yield, Launch Features

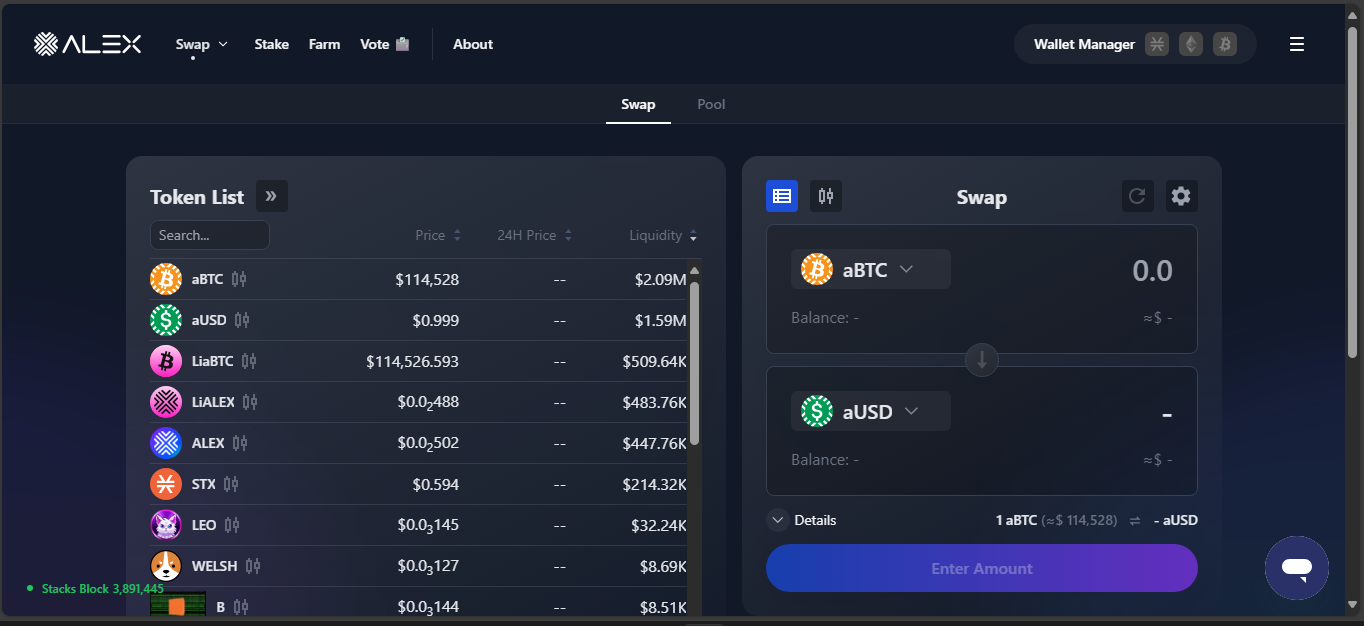

Users can lend or borrow with set rates and terms – no surprises. On the trading side, there’s a DEX with a clean interface, farming for yield, and a launchpad (IDO hub) for new projects. The platform supports staking and yield farming too. Essentially, it tries to be your crypto financial Swiss army knife on Bitcoin.

Founders With Clout

ALEX is the brainchild of Dr Chiente Hsu and Rachel Yu – DeFi veterans with resumes from banks like Credit Suisse, Goldman Sachs, JPMorgan and Morgan Stanley. They built the platform with that experience in their backbone.

Modest Activity, Not Yet Tracked

CoinMarketCap labels ALEX as “Untracked” when it comes to volume and liquidity. That suggests early-stage adoption. CoinGecko notes about 11 coins and 20 trading pairs, with trading volumes in the low-thousands of dollars and moderate activity on pairs like ALEX/STX. It’s there, but quietly so.

Strengths & Weaknesses at a Glance

Strengths:

- All-in-one DeFi platform on Bitcoin through Stacks

- Fixed-rate lending and mixed pools to manage risk smartly

- DEX, farming, launchpad, staking, lending – full stack DeFi

- Strong founders with institutional finance background

- Open-source and programmable via Clarity contracts

Weaknesses:

- Currently untracked volumes and relatively low liquidity

- Not yet widely visible or adopted in DeFi mainstream

- Risk models and pools are sophisticated – may feel complex for first-timers

Final Thoughts

ALEX is ambitious and well-conceived – bringing traditional DeFi infrastructure to Bitcoin’s security layer. It wraps lending, yield farming, asset swaps, and token launches into a singular stack, all anchored by conservative financial logic.

If you want to experiment with Bitcoin-backed DeFi and value deep features over hype, ALEX is worth exploring. Just know it’s still evolving – and still building its community and traction.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”