Azbit – Exchange Review

Quick Background

Azbit went live in 2019 under Seychelles registration. Early backers included Roger Ver, which gave it a burst of attention. The goal was to bridge traditional finance and crypto, with services for both retail traders and businesses.

Market Coverage

The exchange offers spot and futures trading, staking, savings accounts, and supports initial exchange offerings. It also runs a launchpad and provides white-label solutions for developers.

Key Stats Table

| Metric | Value |

| Founded Year | 2019 |

| Headquarters | Seychelles |

| Trading Types | Spot, Futures |

| Extra Services | Staking, Savings, IEOs, Launchpad, White-label |

| Daily Volume | Highly variable – from low to multi-billion USD swings |

| Regional Limits | Blocked in the US and some other regions |

| Security Rating | Mixed – expert scores fair, user trust low |

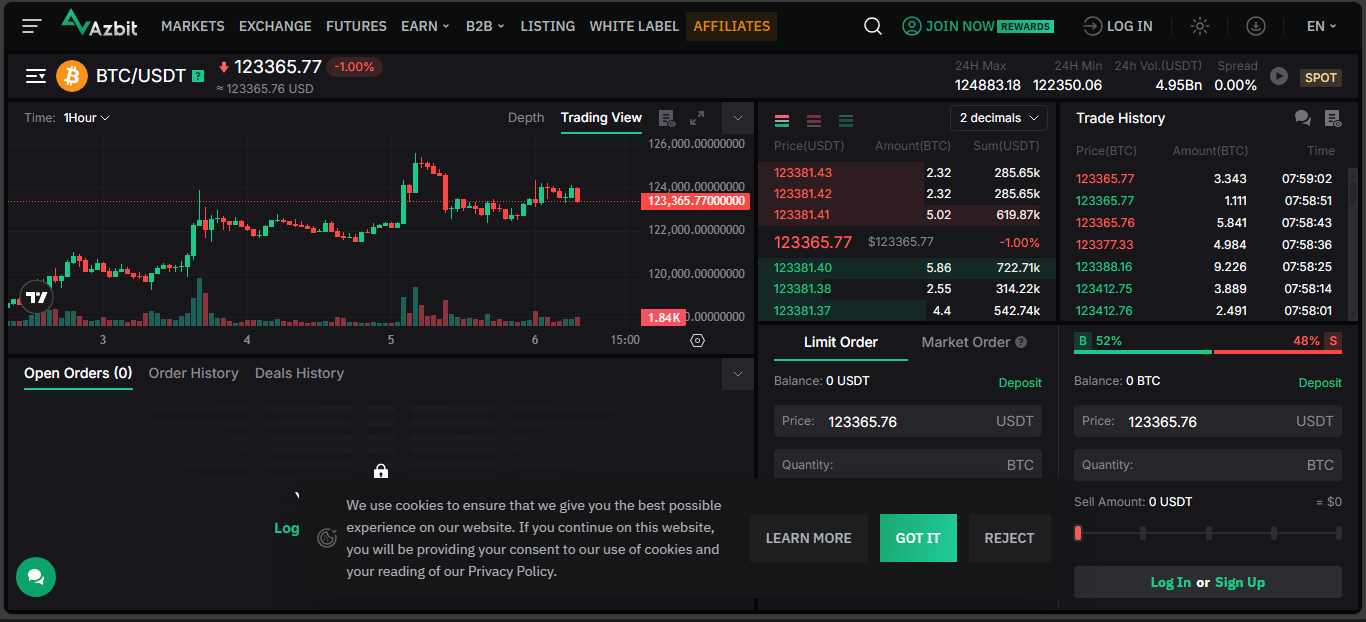

Trading Experience

Azbit offers both simple and advanced trading interfaces. It works on desktop and mobile, with staking and savings aimed at passive income seekers. Business clients can use its launchpad and white-label options.

Security and Trust

The platform claims cold storage for funds, 2FA, KYC, and Proof-of-Reserves. However, user ratings are low, with many citing withdrawal delays or issues. The exchange is only registered in Seychelles, with no stricter licenses from major regulators.

Strengths and Weaknesses

Strengths:

- Broad service range from spot and futures to staking and launchpads

- Tools for both individual traders and B2B clients

- Early support from known crypto figures

Weaknesses:

- No access for US traders and several other countries

- Poor user trust ratings and reports of withdrawal issues

- Minimal regulatory oversight

Reputation and Traffic

Expert reviews rate it moderately well, but user feedback is largely negative. Complaints about slow or blocked withdrawals dominate. Traffic and reported volumes are inconsistent, and the exchange holds a weak or untracked position on global rankings.

Who It Suits

Azbit once appealed to traders looking for niche altcoin listings, IEOs, and staking rewards. Now, it is more relevant for analysts studying exchange risk cases. It is not a safe choice for traders who value regulation and consistent reliability.

Final Thoughts

Azbit started with ambition – a wide set of features, staking, futures, and token launches. But in crypto, trust is everything. Poor user experiences and minimal regulation have overshadowed its product lineup. Unless it rebuilds credibility and compliance, it will remain an example of how potential can be lost quickly.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”