Belt Finance – Exchange Review

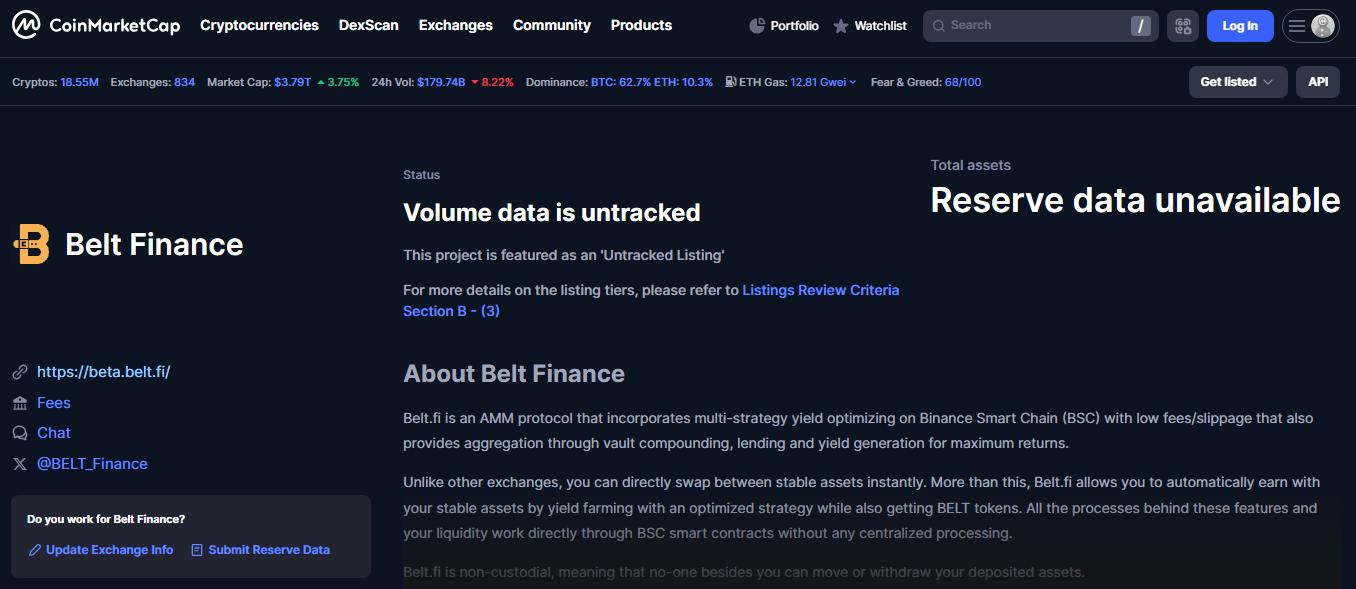

Belt Finance launched as a stablecoin-focused AMM and yield optimizer on BSC. It bundles vault compounding, stablecoin swaps and BELT token utility under one roof. It rose quickly, but has since settled into a quieter, specialized niche.

Protocol Summary

- Focuses on stable-focused liquidity via smart vault aggregation

- Auto-compounds yield across partnered protocols

- Native token BELT supports governance and fee capture

- Built entirely on BSC, with minor cross-chain presence

These features aim to minimize slippage and impermanent loss while boosting yield.

Usage and Liquidity

- TVL sits around $16 million on BSC

- 24-hour DEX volume is nominal – around $400 daily

- Most tokens are staked – over 75%

- Overall trading activity remains minimal for an AMM

The protocol remains active, but far from trendy or high-traffic.

Revenue and Tokenomics

- BELT holders access vault revenue from swaps and yield farming

- Stakers captured around $440k in BELT by staking – fees flow to LPs

- Core strategy mixes low-risk stable returns with auto-compounding

- A past buyback-and-burn model underperformed as TVL plateaued

Security and Reliability

- Subject to multiple audits and bug bounty systems

- Transparent team with an open codebase

- A flash-loan exploit in May 2021 cost around $6.3 million – patched promptly

Strengths

- Vaults offer automated strategies with minimal management

- Stablecoin AMM design reduces slippage and impermanent loss

- Strong audit history and BSC-native focus

- BELT token supports governance and fee-sharing

Weaknesses

- Limited to BSC with little cross-chain presence

- Asset class confined to stablecoins and paired liquidity

- TVL and volume well below mid-tier DeFi standards

- Yield strategies haven’t scaled with inflation or demand

Who It’s For

Targeted at:

- Users seeking stable, low-risk yield without active vault management

- BELT holders wanting governance roles and fee rewards

- BSC-focused DeFi participants with modest portfolio sizes

Not ideal for:

- Traders needing diverse token access or high throughput

- Yield chasers aiming for volatile, high-APR pools

| Metric | Approximate Value |

|---|---|

| TVL | ~$16 million |

| Daily Volume | ~$400 |

| Staked BELT | ~$442,000 (≈80% of supply) |

| BELT Market Cap | ~$500,000 |

| Daily Fees | Minimal |

| Security Events | One flash-loan exploit (2021) |

| Audit and Bounty | Active |

Final Take

Belt Finance remains a steady, low-volatility DeFi tool for BSC users focused on stablecoin vaults. It serves a conservative niche well and has strong technical foundations. But its ambition has slowed, with limited growth, chain reach and activity. For users who want passive yields from stablecoins, it’s a solid pick. For those seeking broader exposure or higher APRs, larger multi-chain vaults or AMMs are a better fit.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”