BloctoSwap – Exchange Review

BloctoSwap claims the title of the first on-chain AMM exchange built on the Flow blockchain. Marketed by the Blocto team, it offers token swapping, cross-chain bridges, staking options and a native token (BLT) that powers rewards and governance.

Live metrics and trading pulse

Current data shows BloctoSwap is classified as an untracked exchange on major aggregators, and there is no visible trading volume or listing information. Over the past month the platform has recorded almost zero transactions and no on-chain user activity. Total value locked sits around 600k-700k USD, which suggests some liquidity is deployed, but usage remains dormant.

What it promises (but barely delivers)

BloctoSwap advertises standard AMM features – swap between Flow-native tokens, run liquidity pools with 0.3 percent fees, cross-chain Teleport bridging to Ethereum, BSC or Solana, plus staking and launchpad utilities with BLT token rewards. In theory, liquidity providers earn BLT plus a share of fees, and holders can stake and participate in governance. Yet most of these functions remain inactive or unsupported with no documented usage.

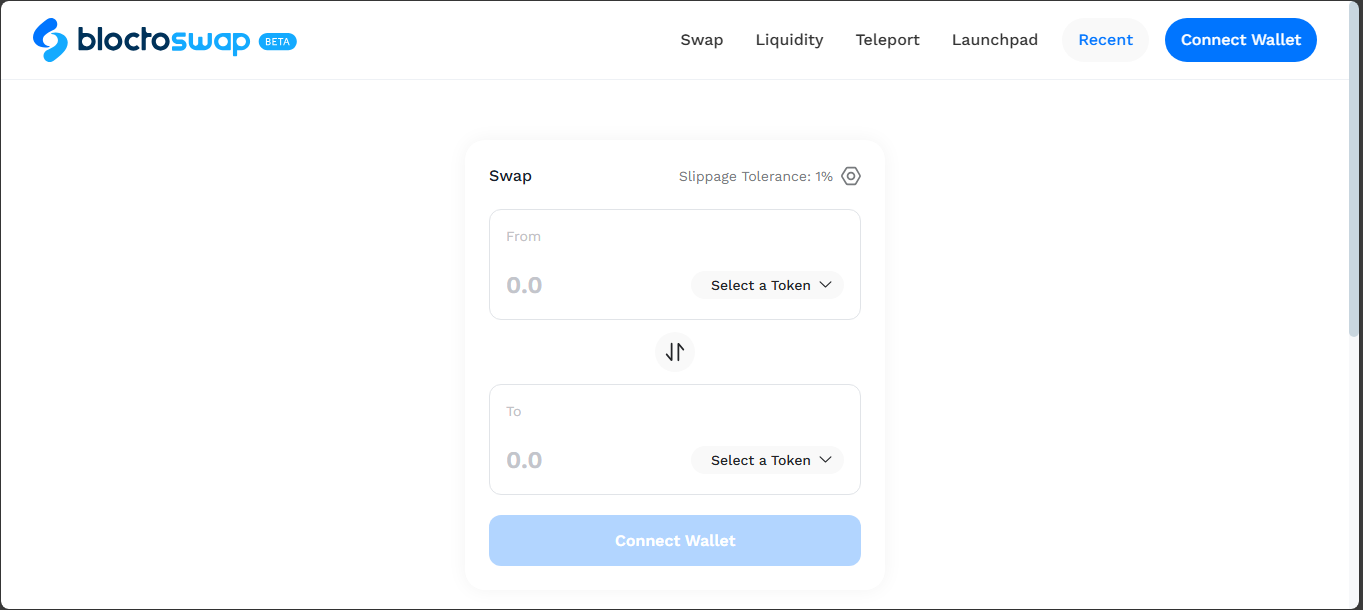

Interface and wallet integration

BloctoSwap is integrated with the Blocto wallet portal, offering cross-chain teleport swaps from Flow into assets on other chains. However, a working user interface, live trading depth, or app experience is not clearly visible. Users rely mostly on project claims rather than observable features.

Tokenomics and economic setup

The platform’s utility token – BLT – is designed for governance, staking and a share of swap revenues. Circulating supply is measurable in the low hundreds of millions, though liquidity is minimal. With TVL still under a million dollars, engagement appears very limited. No transparent yield rates or lock-up mechanics have been confirmed publicly.

Hypothetical strengths

- Being Flow’s first AMM-based DEX gives it a platform-level advantage if it develops properly.

- Cross-chain Teleport functionality could provide a seamless bridge hub from Flow to Ethereum, Solana, and BSC.

- BLT token aligns incentives of liquidity providers, stakers and governance in a typical DeFi reward model.

Real weaknesses and risks

- No visible trading activity – no trades, no volume, no real users on-chain.

- Opacity around platform usability – unclear interface, no public user flows, vague roadmap.

- Low liquidity and TVL makes swap execution or big trades unrealistic.

- Token usage remains theoretical – no visible staking rewards, no governance events, no revenues distributed.

Who might use it (if active)

If BloctoSwap ever fully launches, its audience could include:

- Flow-native asset traders looking for low-fee swaps.

- Liquidity providers seeking token-based incentives.

- Multi-chain users leveraging cross-chain teleport features.

Verdict and outlook

BloctoSwap is an undeveloped DEX concept rather than an active exchange. Despite its presence as Flow’s first AMM offering, actual trading is nonexistent. While a small amount of liquidity is locked, the absence of user activity, token utility, and functional features makes it a dormant project. Unless volume and engagement grow, and its interface goes live, BloctoSwap remains speculative and high-risk. For now, it is better to watch and wait for tangible progress.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”