C-Patex – Latin America Crypto Gateway Deep Dive

Foundation & Regional Focus

C-Patex was born out of Crypto Patagonia S.A. – a venture aiming to bring seamless crypto access to LATAM users. It carved its niche by offering peso trading, local support, and compliance with Argentine regulations. It stands today as a functional gateway between fiat and crypto in the region.

Services & Platform Capabilities

C-Patex supports spot trading across roughly 12-15 crypto assets and a similar number of trading pairs, including major names like BTC, ETH, XRP, ADA, SOL, and LINK.

Users can deposit Argentine pesos (ARS) via bank transfers, trade directly on the exchange, and access OTC services for large orders. Fee structure scales by trading volume but caps near 0.2% per trade, with no crypto deposit fees.

They also offer project listings and Initial Exchange Offerings (IEOs), enabling token launches within the platform environment.

Ecosystem & Educational Integration

C-Patex is not just a CEX. It is part of the broader Patex ecosystem, which includes a Layer-2 network, educational platforms, and CBDC incubation tools aimed at LATAM markets.

Patex develops blockchain careers, academic content, and tools for CBDC issuance. Its native token, PATEX, connects all these products and incentivizes ecosystem participation.

Performance & Liquidity Snapshot

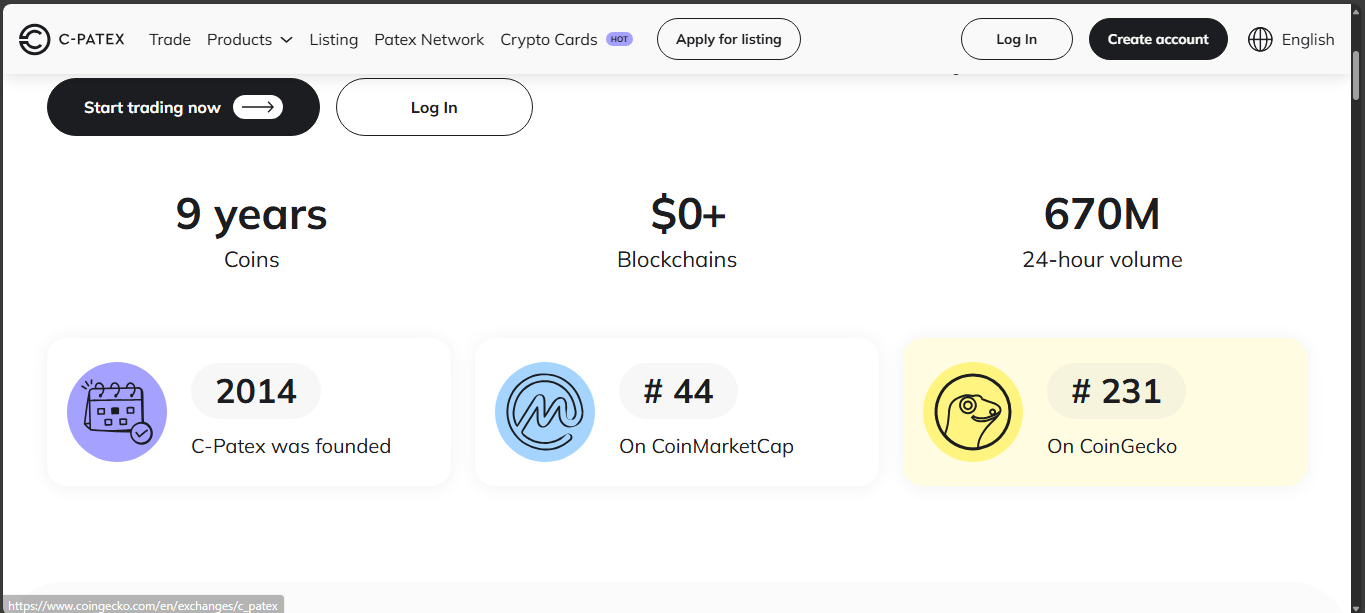

Daily trading volume on C-Patex lands in the ballpark of 130-137 million dollars, placing it in the mid-range of exchange rankings (around #80 globally).

The most active trading pairs – ETH/USDT and BTC/USDT – command large shares of volume, often each accounting for over 30-40% of the daily total.

Reports indicate a Trust Score of 5/10, indicating moderate legitimacy but limited transparency metrics like proof-of-reserves or audit data are missing.

Strengths vs Weaknesses

| Strengths | Weaknesses |

| Local fiat rails via ARS & Argentine banking | Limited coin selection (around 12-15 assets) |

| Integrated LATAM-focused ecosystem & education | No public proof-of-reserves or audit disclosures |

| Competitive, volume-based fee structure | Moderate trust scoring and low global visibility |

| Launchpad and OTC functionality | Fiat options limited to Argentina, international reach low |

Challenges & User Confidence

Despite regional strengths, C-Patex has visibility gaps. It does not disclose reserves or liquidity data publicly, which dents trust among institutional or foreign users.

The small asset selection limits diversified portfolio trading. And while ARS fiat is its edge, lack of broader fiat lanes restricts international expansion.

Yet, on the LATAM front, its combination of local support, educational content, and ecosystem synergy has forged user confidence – it is seen as a practical entrance into crypto for regional newcomers.

Outlook & Future Potential

C-Patex stands on solid regional foundations. Its connection to Patex’s broader ecosystem opens doors for future CBDC launches, Layer-2 DeFi integrations, and educational growth.

Scaling internationally would require broader fiat gateways, transparency upgrades (proof-of-reserves, audits), and expansion of asset offerings.

For Latin American users seeking local fiat access and community alignment, C-Patex remains a go-to. For global traders, it is a project under watch – reflecting both creative vision and work-in-progress execution.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”