Canary Exchange – Exchange Review

What is Canary Exchange

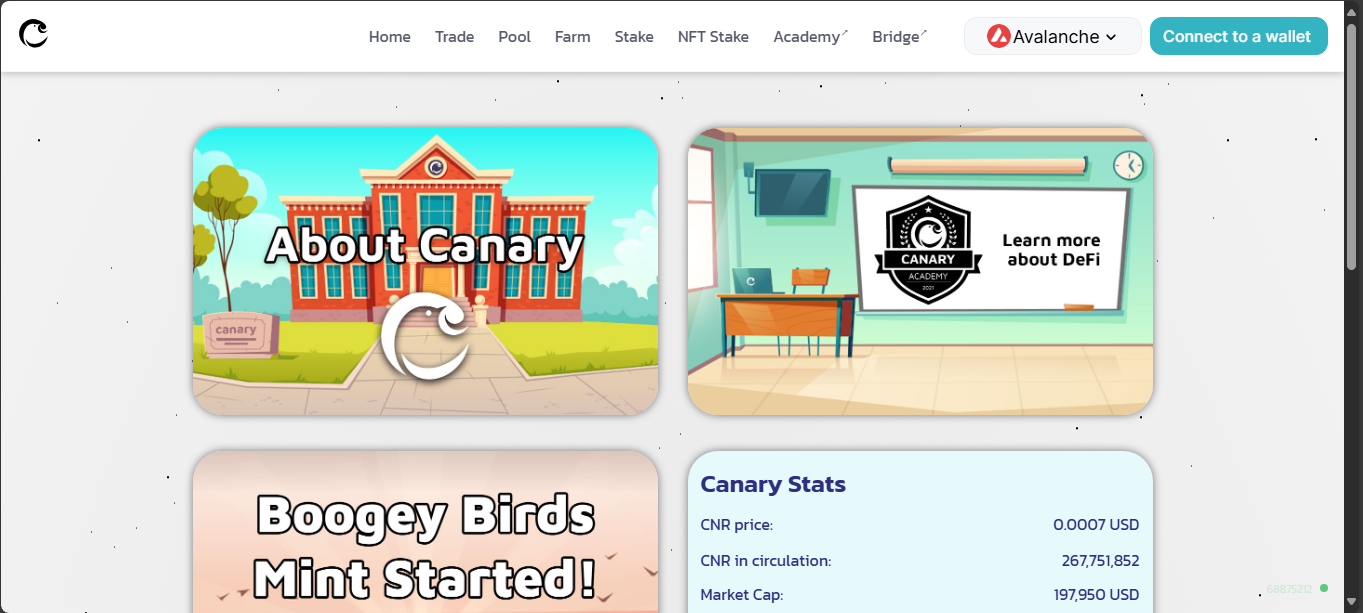

Canary Exchange is a decentralized exchange built on Avalanche (and also on Scroll). It uses the standard AMM model – liquidity pools instead of orderbooks. It even launched its own token, CNR, that users could earn by swapping, staking, or participating in ecosystem activities.

Volume and current status

On-chain data paints a flatline. Daily swap volume is effectively zero. In the past it had only very small traffic – less than $40 in daily trades over 30 days and virtually nothing day-to-day. CoinMarketCap marks the project as untracked or inactive. There’s no real liquidity or user activity anymore.

TVL and token stats

Protocol numbers show around $68k locked in total across Avalanche and Scroll, but that’s inactive capital stuck in pools. CNR token exists on-chain with a history of a high around $0.32 – now down to under $0.001. Circulating supply is unclear; token transfers are rare and often stalled.

Transparency and development

Some developer activity was present – last commit happened a month ago – but it’s minimal (1 commit and 1 dev weekly). That’s barely enough to maintain code, far from active feature development. There are no visible audits or regular community engagement.

Pros and Cons

Pros:

- Built on reliable chains (Avalanche, Scroll)

- Tokenomics included staking and liquidity rewards

- Open-source AMM model anyone can fork or integrate

Cons:

- Negligible volume and flatlining liquidity

- TVL is tiny and unused

- Token price down 99.7% from peak

- No community, no traction, no transparency

- Inactive development and untracked status

Who it might suit

In its early days, Canary might’ve appealed to DeFi tinkerers who just wanted to test a new AMM on Avalanche. But with zero activity now, it’s only for those who want to study dead DeFi experiments or salvage leftover funds on-chain.

Final verdict

Canary Exchange is a defunct DeFi setup. It launched with promise – AMM mechanics, tokens, staking – but it failed to gain or hold users. With trivial daily volume, minimal locked funds, token almost worthless, and no ongoing development or transparency, it has zero utility today.

It’s worth keeping in a “DeFi archeology” folder, but not anything you’d trade on or rely upon. The project is essentially dead.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”