Catex (Cat.Ex) – Exchange Review

Platform Overview and Tokenomics

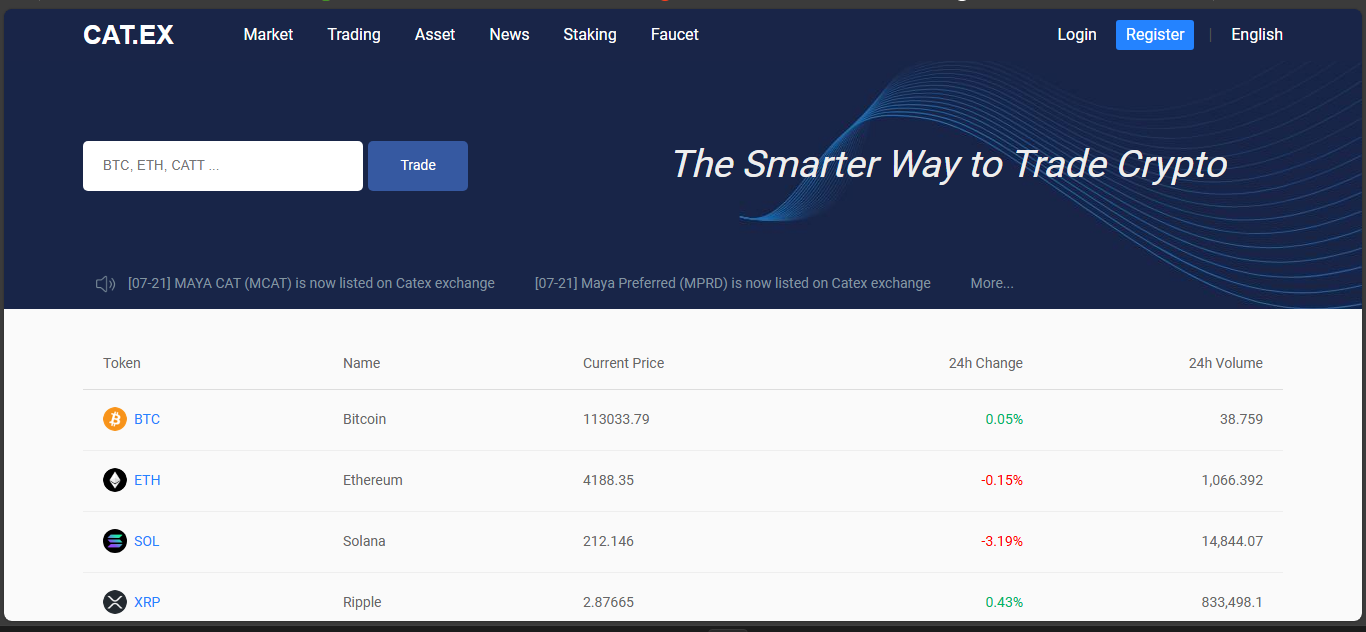

Catex launched in mid-2018 as a crypto-to-crypto exchange, aiming to serve markets across Brazil, Vietnam, South Korea, Bangladesh, Russia, Turkey, the Middle East, India, Indonesia, and the U.S. It promised fast, simple crypto trading with a distributed microservice architecture and multiple community touchpoints.

The spotlight shines brightest on its native token, CATT – built on Ethereum/BEP-20. CATT holders get fee discounts, voting rights on listings, staking yields, and dividends from 80% of daily platform revenue paid into a reward pool. The dividend logic was supposed to build loyalty and repeat trading. Total supply hovers around 10 billion tokens, with roughly 764 million circulating.

Real-Time Activity and Market Presence

So how’s it doing? Mixed results.

Catex exchange logs substantial volume – some data shows around 74 million USD in 24-hour spot volume across markets like ETH/USDT (~8.5M USD), BTC/USDT (~5.8M USD), DOGE/USDT (~5.2M USD), plus a scattering of meme or alt pairs.

Meanwhile, CATT token itself is stalled. Price metrics are sketchy – live price sits near zero. Reports show around 403 billion CATT in circulation out of 886 billion total, with 24-hour token volume under 14K USD and a market cap near 2.4K USD. This disconnect tells two stories: active exchange operations versus stagnating token traction.

Community tools are active but limited. Telegram members number about 5.5K. Twitter followers reach around 23K, web traffic steady at about 396 organic visits per month. Decent – but not vibrant engagement for an exchange claiming global reach.

Strengths and Weaknesses

Strengths

- Broad feature set: trade, stake, farm, vote, earn dividends.

- Low fees: base at 0.1%, reduced by holding CATT for discounts and benefits.

- Global ambition: user base across many emerging economies.

- Revenue-sharing model: an attempt to align user incentives with platform growth.

Weaknesses

- Token fundamentals weak: CATT trades in near-zero volume, market cap essentially symbolic.

- Community signals murmur – not roar. Social media, traffic, activity correspond to headline gloss, not engagement.

- Traders report lukewarm sentiment – scores hover around 3/10, citing poor trust and support issues.

- No mobile app, basic UI, and staking only through browser interface – missing mainstream polish.

Snapshot Table

| Component | Details |

| Platform Type | Centralized exchange with DeFi-like features (staking, dividends) |

| Launch Year | 2018 |

| Key Token (CATT) | Utility + revenue token, voting, dividends, staking |

| 24h Exchange Volume | ~74M USD (spot markets) |

| Token Volume/Circulation | ~14K USD volume, ~403B circulating of ~886B total |

| Strengths | Low fees, token benefit model, regional footprint |

| Weaknesses | Token illiquidity, low trust score, weak engagement, UX limitations |

Final Thoughts

Catex builds on a solid blueprint – exchange features layered with token utility, revenue sharing, and regional reach. There’s daily volume and real trading happening, especially in spot markets, with a clear path for token holders to benefit if the system scales.

But here’s the issue: the native token CATT is dormant. If it’s meant to propel the platform through user alignment and dividends, it’s firing blanks while the underlying engines hum on the exchange.

For active traders in emerging markets, Catex is an order book and toolset. For token holders looking to earn or influence, the mechanics exist but the traffic – and rewards – haven’t shown up.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”