CoinJar – Exchange Review

CoinJar started back in 2013, when trading crypto was far from mainstream. It came out of Melbourne and gave locals an easy way to buy Bitcoin. No big plans, just a clean tool that worked. Over time, it added other coins, launched a card, and gave users ways to track their balances. The idea stayed the same – keep things simple, stay safe.

From niche startup to regulated player

In its first years, CoinJar built credibility through transparency and a focus on beginners. It didn’t chase hype or advanced products, instead becoming one of the earliest regulated crypto brands in Australia. This helped it survive market cycles and regulatory scrutiny. But the same cautious approach limited its growth outside the local market.

What the platform offers today

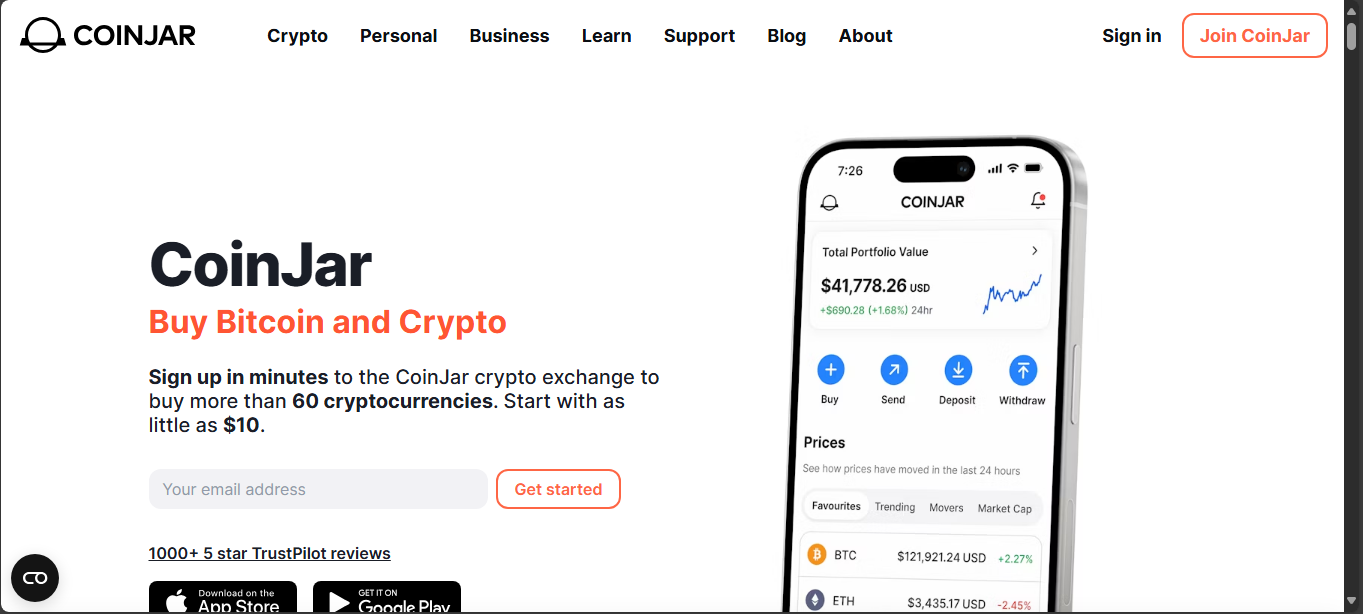

CoinJar has expanded beyond simple swaps, but remains a streamlined service:

- Buy and sell crypto with AUD support.

- CoinJar Card for spending assets as cash.

- Portfolio tracker built into the app.

- Mobile app that keeps things functional, if not feature-rich.

It’s an easy on-ramp for locals, but offers little for advanced traders or global investors.

Compliance and security posture

CoinJar emphasizes regulation and security:

- Registered under Australian AML and KYC rules.

- Majority of funds stored in cold wallets.

- Multi-signature protection and routine audits.

While this boosts trust, it also comes with trade-offs: stricter identity checks, fewer features, and no global competitive edge compared to offshore platforms.

Where CoinJar falls short

CoinJar never scaled to compete with larger exchanges. It lacks derivatives, deep liquidity, or wide token variety. On global trackers, its volumes look modest, and many pairs suffer from thin activity. Advanced tools for margin trading, staking, or yield farming are absent, which leaves active traders looking elsewhere.

User sentiment

Australian users often appreciate CoinJar’s simplicity and regulatory clarity. But outside that base, reviews highlight its limited coin selection, lack of liquidity, and higher effective spreads compared to international rivals. For those seeking deeper markets or high-volume execution, it’s rarely a first choice.

Pros and cons

Pros

- Beginner-friendly and straightforward.

- Fully regulated in Australia.

- CoinJar Card adds real-world usability.

- Transparent fee structure.

Cons

- Small global presence and modest volumes.

- Fewer assets than most competitors.

- Limited advanced features for active traders.

- Liquidity gaps on many pairs.

Final verdict

CoinJar carved out a stable niche in Australia by focusing on compliance, trust, and simplicity. But its limited scope, modest liquidity, and absence of advanced products make it a minor player globally. For newcomers who value regulation and ease of use, it’s still a safe choice. For serious traders, however, CoinJar is more of a stepping stone than a destination.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”