CronaSwap – Exchange Review

A launch that felt local-global

CronaSwap hit the scene in 2021 as Cronos Chain’s home-grown DEX – a Polkadot-to-Ethereum-style platform built around low-cost, high-speed swaps. Imagine combining DeFi access with Cronos-native flair: a platform where you can swap, farm, stake, and launch – without slow Ethereum fees or central gatekeeping. It mattered because it leaned into Cronos identity while carrying builder ambition.

Core gear and DeFi toolkit

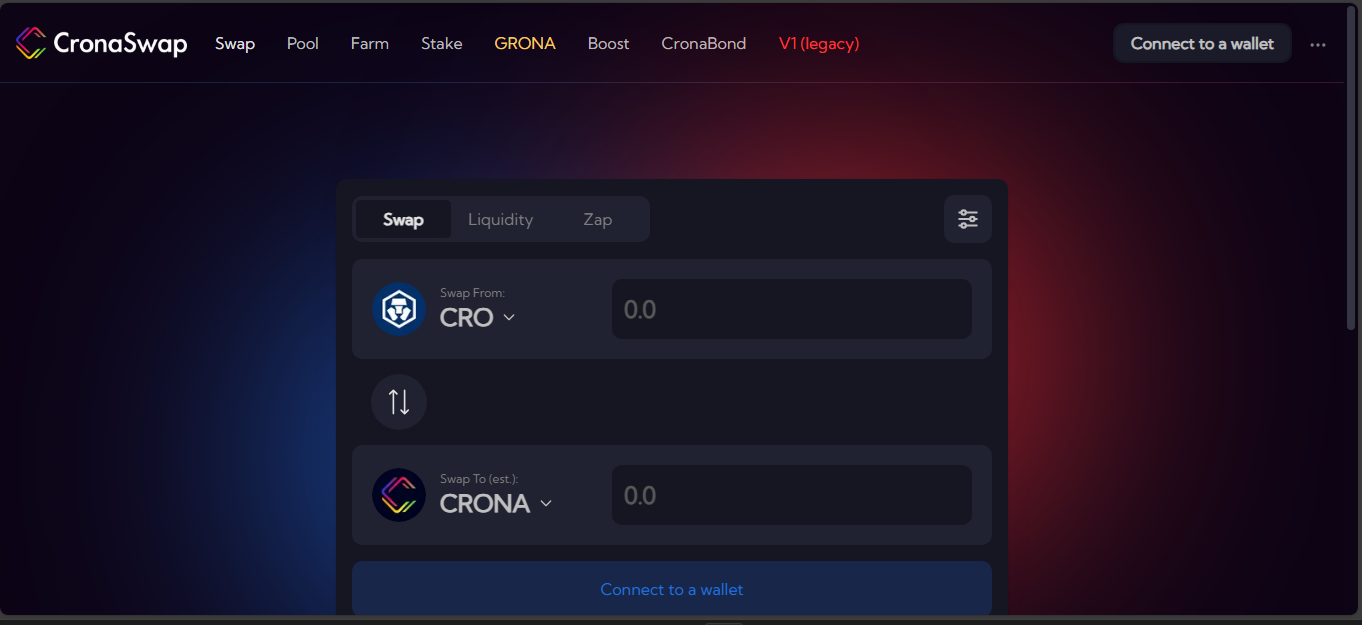

What CronaSwap serves up is classic AMM wrapped in Cronos speed:

- Token swaps between CRC-20 assets with just a 0.25% fee – among the lowest around.

- Yield farming and launch pools to stake and grow CRONA or other assets for rewards.

- Launching token projects via pools – CronaSwap pushes fairness in early DeFi listings.

- Supported by a lightweight AMM engine – fast, Cronos-native, swaps finalized in seconds, not minutes.

It’s DeFi at speed, wrapped in Cronos comfort.

Deeper dive into value and limits

CronaSwap delivers compelling features – but there are gaps:

- TVL sits around $700K, with staking taking about $35K. It’s small, but meaningful in Cronos terms.

- Not yet audited; no CertiK or equivalent – security depends more on community and internal checks.

- User reviews are mixed: some praise innovation and autonomy, others flag data transparency or risk concerns.

- Volume fluctuates – trades can feel lonely during low-activity hours.

In short: it’s a capable toolset with DeFi DNA – just not for autopilot conservators.

Who benefits most – and who might fall

If you’re navigating Cronos with DeFi-savvy mindset, CronaSwap is fertile ground. Fast swaps, low fees, yield layers and launch tools create opportunity. Combine that with CRONA mechanics and you get strategic flexibility.

But if you’re about deep pools, wide token liquidity, auditing guarantees – this isn’t your home court. It’s best for active risk-managing DeFi users, not passive trend followers.

Flash pros vs simmering cons

Strengths:

- Ultra-low swap fees (0.25%) and Cronos-speed transactions

- First-mover AMM on Cronos Chain – credibility in timing and execution

- Farming, staking and launch pools add DeFi yield variety

- Lightweight, UX-friendly DEX with Cronos ecosystem alignment

Weaknesses:

- Low liquidity and volume mean vulnerability to slippage

- No formal audits – security depends on goodwill and bounty programs

- Regulatory status unclear and minimal user protection

- Small TVL means platform still plays in baby leagues of DeFi landscapes

DeFi lesson from CronaSwap

CronaSwap teaches that local-chain DEXes can bloom if they match utility with ecosystem culture. Low-cost DeFi needs fast execution to feel real. But liquidity and trust – the essential twin – cannot stay on the backburner.

If you design DeFi tools on emerging chains, build for adoption and transparency – not just features.

Final thoughts – where CronaSwap stands

CronaSwap is a lean DeFi engine for Cronos. It offers swaps, stake returns, and launch options at scale speeds with a Cronos-native identity. A solid starter for active DeFi players on Cronos.

If you want governance, audited contracts or deep liquidity – look elsewhere. But if you’re savvy, curious, and ready to pilot yield and tokens, this DEX gives you nimble advantage.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”