Curve Finance – Exchange Review

Stablecoin battling – Curve refines AMMs

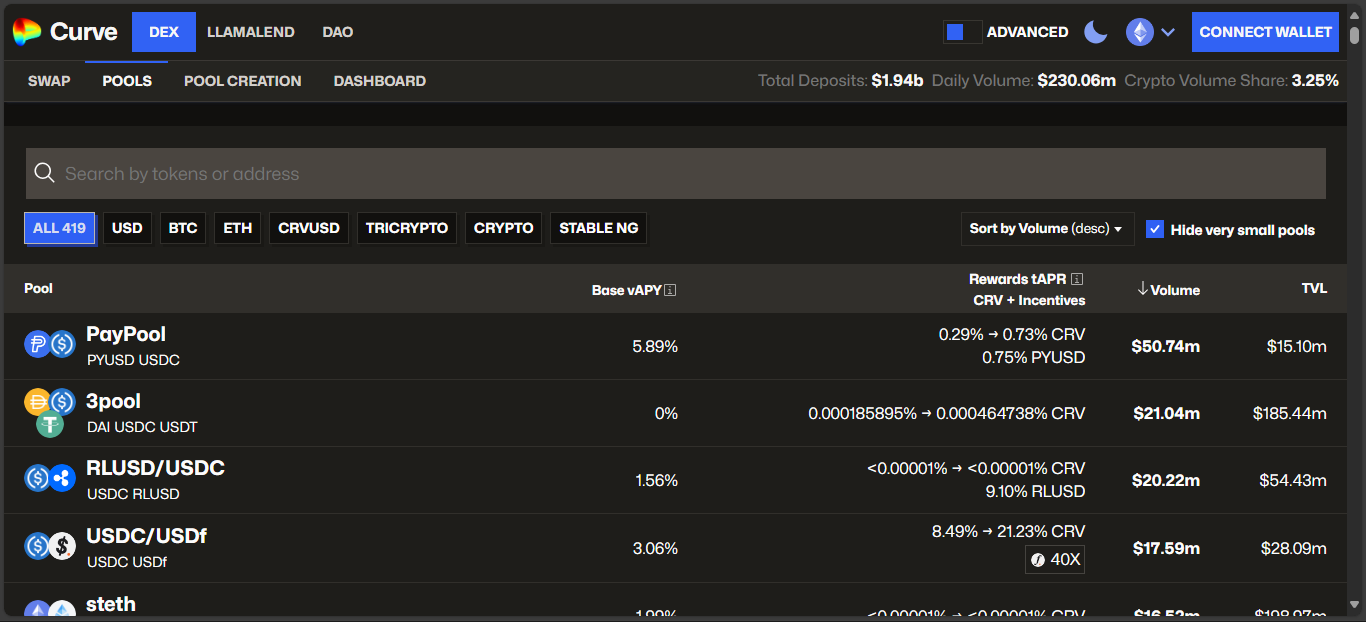

Curve Finance launched in 2020 with a tweak on the AMM model: only pool together assets that behave similarly – like USDC, DAI, or wrapped BTC variants. That allows tight slippage and tiny fees, pushing Curve into the DeFi spotlight for anyone swapping stablecoins efficiently.

What makes it special under the hood

Curve doesn’t use order books. Trades flow through smart contracts managing liquidity pools, with math fine-tuned for like-asset matching. That means even big stablecoin trades clear with minimal slippage and lower impermanent loss risk.

Liquidity providers earn not just swap fees, but also DeFi composability bonuses – they can stake cDAI or other tokens within Curve, layering interest and rewards.

The CRV token plays double duty – rewarding liquidity contributors and enabling voting in Curve’s DAO via vote-locked veCRV governance structures.

Ecosystem depth – where Curve runs

Curve sits across Ethereum and EVM chains, supporting stablecoin pools, wrapped-native asset pools, even launching its own stablecoin crvUSD and lending features. Despite competition from Uniswap, its specialized approach leaves it uniquely efficient for low-risk liquidity.

Strength in numbers – why users care

- Ultra-low slippage, even on large trades

- Minimal fees, optimized for stable assets

- Yield layering via composability – CRV plus pooled assets

- DAO governance through veCRV locking and proposals

Curve’s focus on efficiency over volatility made it a DeFi favorite, especially for swapping stable or wrapped assets.

Behind the brilliance – risks and roadblocks

Curve isn’t invincible. A 2023 smart contract attack exploited a specific Vyper compiler issue, leading to over 50 million dollars lost, though some funds were returned and a bounty offered.

LPs also face subtle threats – stablecoins can depeg, and Curve-specific pools require vigilance. Academic models detecting depegs and unfair trades exist to help liquidity providers stay sharp.

Interface complexity and deep liquidity strategy may scare casual users. Curve works best when DeFi understanding is solid.

Summary – what Curve does best and where it falls short

Strengths:

- Stablecoin specialist with ultra-efficient swaps

- Composable yield strategies with external DeFi integrations

- Governance via CRV locking brings user power

Weaknesses:

- Historically exploitable smart contract edge cases exist

- Requires active liquidity management and risk awareness

- DAO centralization risk remains until votes decentralize further

- Not suited to volatile asset speculation

Lessons learned from Curve Finance

Curve built DeFi focused on utility – knowledge beats hype. Liquidity efficiency and strategy matter, but so do security and transparency. Innovations like crvUSD show future expansions are alive, but risk must be managed.

Final verdict

Curve Finance stands as a DeFi power user’s dream when efficiency, yield, and composability matter. It refined the AMM model for stable assets – turning swaps into low-cost utility, with governance baked in.

It’s not a casual playground – it’s where DeFi specialists go to optimize yield, manage liquidity, and shape protocol direction. If you ride with strategies, audits, and DAO votes intact, Curve rewards patience and participation.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”