Dexalot – Exchange Review

What is Dexalot

Dexalot is a decentralized exchange built on Avalanche that uses a proper limit-order book instead of the usual AMM model. It launched to give traders familiar tools like those on centralized exchanges but with full custody and chain-native execution. It supports Avalanche-native assets and wrapped tokens, catering to both retail and advanced users.

Trading model and interface

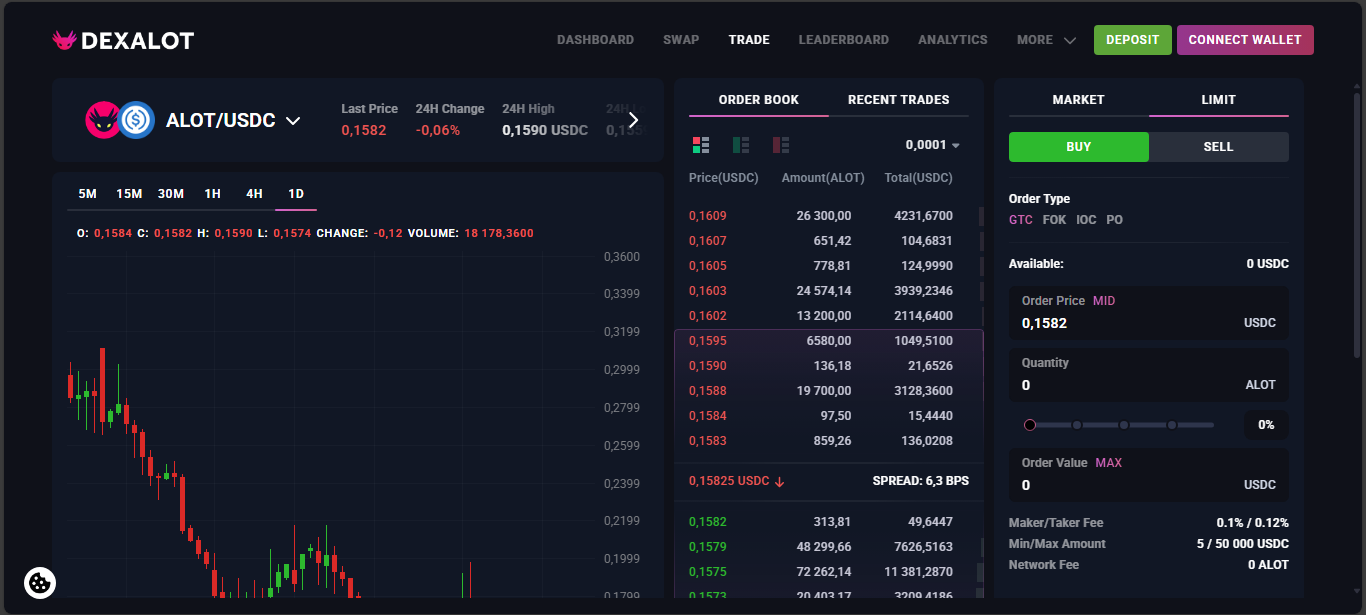

Instead of pools, users place buy or sell orders which sit on the order book until filled. That enables strategies like limit orders, stop limits and post-only trades. The trading interface is clean, fast and intuitive. There’s a browser-based UI and an open API, and support for wallets like MetaMask or Ledger.

Fees are simple and transparent: a flat 0.2 percent per trade, paid in the token of the traded pair. No tiered structure, no confusing levels.

Liquidity and adoption

Volume on Dexalot remains modest. At best it sees tens of thousands in daily trading, but often falls below that. Most trading happens on main pairs like AVAX and cross-chain stablecoins. Order books show low depth, with noticeable price slippage for larger trades.

It has a core niche of Avalanche users but hasn’t attracted mainstream or global liquidity. Community traction exists, but only in that ecosystem.

Security and transparency

Dexalot’s code is open-source and available for inspection. Contracts were audited by reputable firms and audit reports are publicly accessible. There has been no history of hacks so far.

As a fully on-chain CEX-style DEX, user funds remain in custody until a trade executes. That removes counterparty risk and keeps trust embedded in contract logic.

Pros and Cons

Pros:

- True order book trading model on-chain

- Supports limit and stop-limit orders

- Easy wallet integration and API support

- Flat and transparent 0.2 percent fee

- Audited code and open-source contracts

Cons:

- Low liquidity and daily volume

- Limited asset selection, focused on Avalanche

- Higher fees compared to some AMMs

- No fiat on-ramp or margin options

- Mostly used by Avalanche niche community

Who it’s for

Dexalot suits DeFi users on Avalanche who want control over order types and custody without sacrificing decentralized principles. It’s useful for small-to-medium orders with advanced strategies. It’s not the place for heavy volume trading, cross-chain assets beyond Avalanche, or new users seeking fiat entry.

Final verdict

Dexalot delivers a clean and functional on-chain order book experience. It stands out by combining decentralized custody with CEX-style trading features. But its Achilles heel is liquidity. Until it attracts more traders and deeper books, it remains a niche tool.

If you trade Avalanche-native assets and want a decentralized limit order platform, Dexalot is a strong contender. Just don’t expect the depth and traffic of mainstream DEXs or CEXs.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”