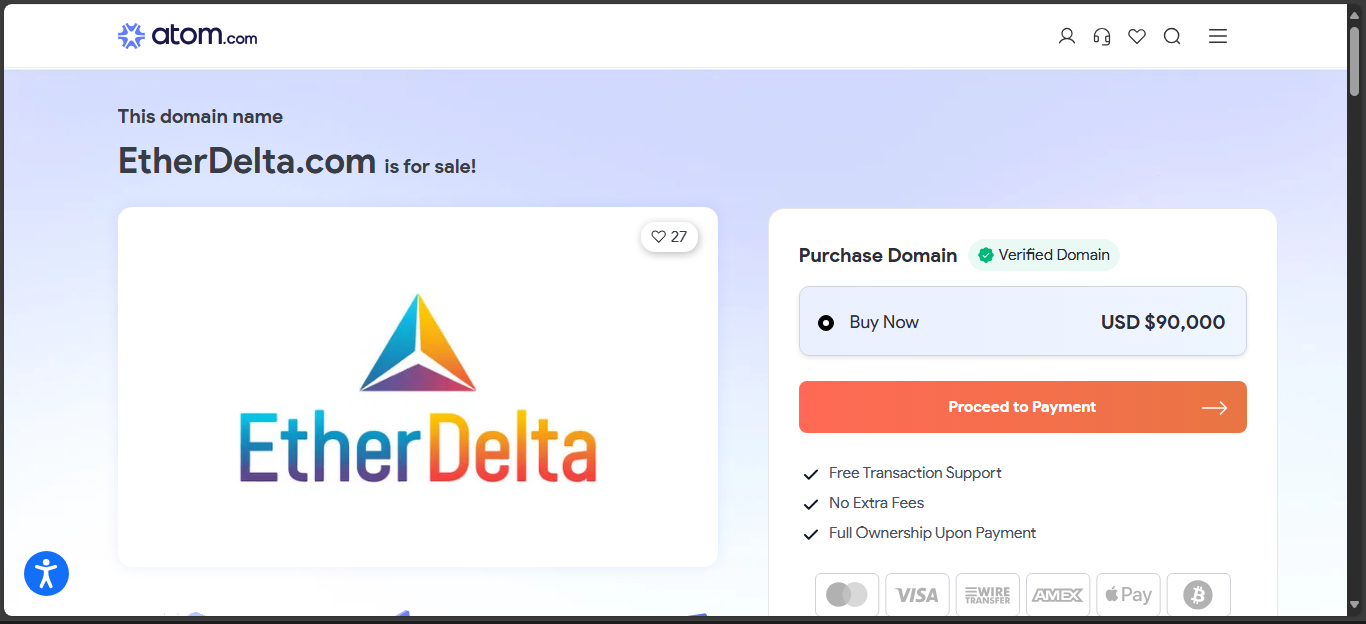

EtherDelta – Exchange Review

First impressions

EtherDelta is one of the earliest decentralized exchanges for ERC-20 tokens, launched around 2017. It offered full non-custodial trading – meaning users connected their own wallets and placed orders directly on-chain. No account creation required, just wallet integration and smart contracts handling everything.

Trading activity and volume

Today EtherDelta is essentially inactive. Public data shows zero trading volume and the exchange is classified as “untracked” due to insufficient activity. There’s no insight into liquidity, order books, or market depth.

Fiat access and interface

EtherDelta has never supported fiat. It was always ERC-20 tokens only. The interface was straightforward: integrated order book, chart, and deposit/withdrawal panel directly on the web page. No mobile app existed – just a simple browser-based UI.

Security and transparency

The platform used smart contracts to keep funds in user custody. That offered security advantages – exchange wallets didn’t hold funds, so hacks on the platform remained limited in impact. Still, there were no public audits or proof-of-reserves, and smart-contract complexity posed risks.

Reputation and user trust

Despite its pioneering role, EtherDelta accumulated trust issues over time. The UI was clunky, and users often made mistakes placing orders. A DNS hack in late 2017 stole over 300 ETH from those who didn’t check domain authenticity.

At peak, the exchange saw about $10 million in daily volume, but that quickly dropped as better DEX alternatives emerged. Eventually, it went dormant.

Strengths and weaknesses

Strengths:

- Full custody of funds – users controlled private keys

- Enabled trading of fresh ERC-20 tokens right after launch

- No maker fees on place orders, only taker fee (~0.3%)

Weaknesses:

- Now inactive with zero volume

- Clunky interface and high chance of user error

- Once suffered security flaws like DNS hijack

- No audits or liquidity guarantees

Who it might suit

EtherDelta today isn’t for active users. Maybe some nostalgic traders or researchers studying early DEX history might explore it – but for trading, it offers nothing. The era it defined is long gone.

Final thoughts

EtherDelta broke ground in decentralized exchange world, pioneering ERC-20 trading without custodial risk. But its UI issues, security incidents, and lack of volume eventually sidelined it. Today it’s a historical artifact, not a choice for traders.

For anyone wanting reliable, active trading, modern DEXes with better design, security, and volume are a far stronger bet.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”