Flamingo Finance – Exchange Review

Snapshot

Flamingo Finance is a multi-protocol DeFi platform originally launched on Neo and later expanded to zkSync and other chains. It offers swap, vault, perp, wrapper, synthetic stablecoin and DAO governance features. With its FLM token, it aims to be full-stack DeFi – but current volume and transparency raise flags.

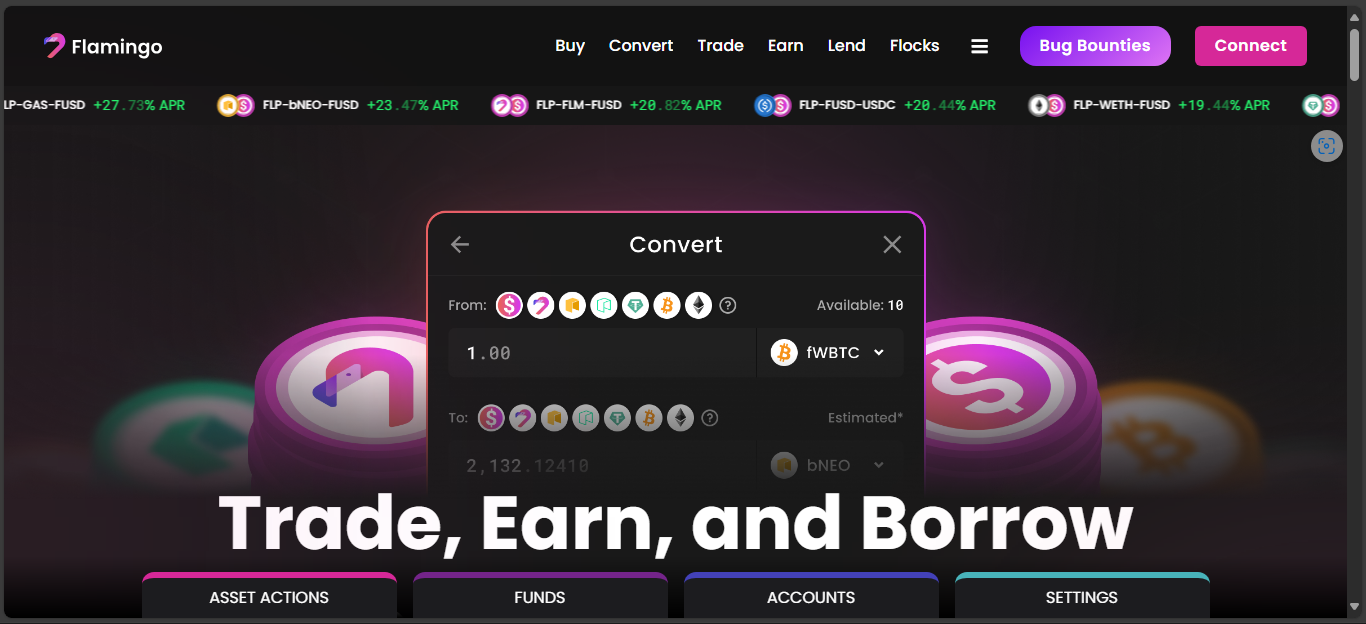

First Impressions

The UI is polished and intuitive, offering swaps, vaults, LP staking, lending and perps. No CEX-style sign-up is needed – just connect your wallet. It reads like a one-stop DeFi shop with familiar layouts and clear menus.

Core Features

Full DeFi Stack

Flamingo combines six modules – wrapper, swap, vault, perp, stablecoin (FUSD) and DAO. That breadth makes it feel like DeFi in one dashboard.

On-Chain Swap and Vault

It uses AMM swaps and strategic vaults to aggregate yield across multiple tokens. You provide liquidity and earn FLM along with swap fees.

Perps and Synthetic Assets

Flamingo offers perpetual contracts and FUSD-based lending – features typically seen on larger DeFi chains.

Governance – FLM Token

FLM holders vote on protocol upgrades, fee distribution, token issuance and asset onboarding. The token is core to governance and yield distribution.

Market Activity and Metrics

- Price: ~$0.0305

- Market cap: ~$16.7M

- 24h volume: ~$1.4M

- TVL: around $14M on Neo legacy

- CMC currently shows untracked volume – other sources report ~$4.45M

- Listed tokens: 10+

- Pairs: FLM-NNEO, FLM-GAS, FLM-USDT, more

These numbers suggest moderate usage, mostly within the Neo and zkSync ecosystems.

Pros and Cons

Pros:

- Comprehensive feature set – swap, vault, perps, stablecoin, DAO

- Built on Neo N3 with cross-chain support

- FLM governance aligns users with protocol growth

- No custody, no sign-up required

Cons:

- Low to moderate on-chain activity for some features

- Transparency gaps – no recent audits or proof-of-reserves

- Binance tagged FLM as “monitoring” – potential risk flag

- No mobile app or live support

Risk Signals

Binance placed FLM under “Monitoring” due to volatility risks. No external audits have been released, and while the team claims robust mechanics, independent verification is lacking. That places Flamingo in the “use cautiously” category for now.

Community Feedback

Some users praise its low-fee, integrated structure. Others point to vague roadmap execution, liquidity fragmentation, and uncertain token economics. Discussions highlight both optimism and concern – especially about long-term viability.

Who It’s For

Flamingo is built for DeFi users wanting a wide range of features under one roof. It’s ideal for explorers who want to experiment with swaps, staking, perps and synthetic assets across chains. Not suitable for large capital holders or risk-intolerant investors due to transparency gaps and market risks.

Final Word

Flamingo Finance presents a powerful full-stack DeFi model with broad features and cross-chain ambition. However, modest activity, lack of audits and Binance’s caution signal moderate risk. For savvy DeFi users it’s a playground worth exploring – but proceed wisely, monitor updates, and don’t go all-in until transparency catches up.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”