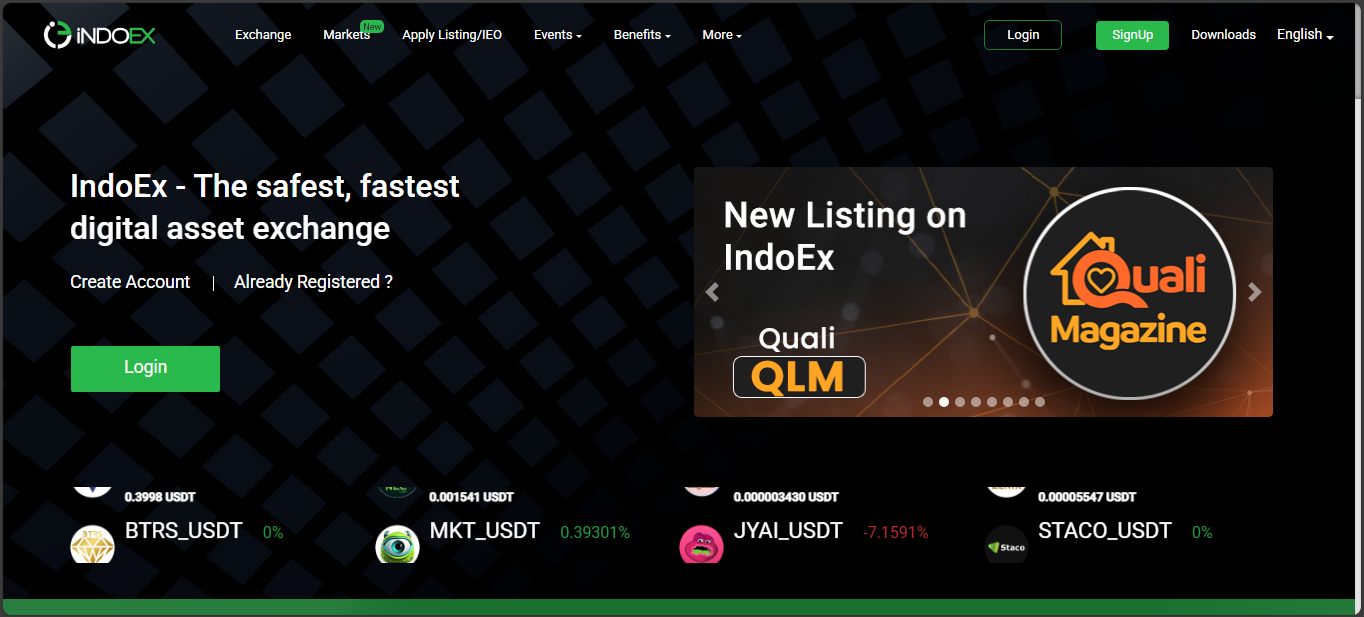

IndoEx – Exchange Review

IndoEx bills itself as a fast, secure exchange born in 2019, operating from Estonia and the UK. Its engine – built with algo traders in mind – promises latency cuts and institutional muscle. Think altcoin depth, smart API support, and a slick UI for both rookies and pros alike.

Quick overview

Here’s the short take:

- Spot trading platform that launched in early 2019.

- Focused on altcoins, algorithmic execution, and speed.

- Offers a launchpad, airdrops, API trading, basic spot pairs – no futures or margin.

- Fee flat at 0.15 %, withdrawals start tight but scale with verification.

- Trusted by some, but red flags lurk – restricted transparency, mixed safety scores.

What it offers

No fluff, but a mixed bag:

- Clean spot engine with TradingView charts and algo-ready API.

- Launchpad for new token drops and referral rewards.

- Easy entry – low deposit, no KYC by default – and 24/7 Telegram support.

- Backing features like two-factor and a secondary PIN for extra layers.

Liquidity and activity now

Volume numbers look decent – billions traded daily across 150+ coins and 200+ spot pairs. Complex pairs like ETH/BTC, SOL/USDT float regularly in mid-tier volume. But real usage is murky – some trackers flag zero activity, and ratings drop when you dig deeper.

Fees and costs

Standard flat fare – 0.15 % for both maker and taker trades. Withdrawals include typical network fees and require full security setup to raise limits.

Onboarding and UX

Sign up is light – email, password, no KYC by default. Wallet features appear minimal, with TradingView for charting and APIs for tactical orders. It moves fast but operates in a quiet zone.

Strengths

What clicks:

- Algo-optimized slot with quick execution and API muscle.

- Altcoin variety and launchpad perks are solid for indie project fans.

- Promotional buzz – airdrops, referral incentives, low entry threshold.

Weaknesses

Where IndoEx trips up:

- No regulatory guardrails, low external audit scores, and unclear transparency.

- Reports of withdrawal issues, unauthorized moves, unanswered complaints loom large.

- No derivatives, margin, staking, or lending – just basic spot plus splashy extras.

Who it suits

Eager altcoin traders, scrappy project backers, and algo geeks who need a fast lane. Skip it if you want custody comfort, regulatory clearance, or safety certainty.

Final take

IndoEx is power tools – fast, flexible, altcoin-friendly – but built in a safety-less workshop. It delivers good gear, but users must choose carefully. If you chase speed and edge, fine. If you pour in without safeguards – you risk a crash.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”