iZiSwap (Mode) – Exchange Review

Snapshot

iZiSwap (Mode) is a decentralized exchange built on the iZUMi and zkSync infrastructure and live since 2022. It uses an innovative discretized-liquidity AMM (DLAMM) model to enable zero-slippage swaps and on-chain limit orders. Despite its tech ambitions, trading volume is modest, and critical trust signals remain murky.

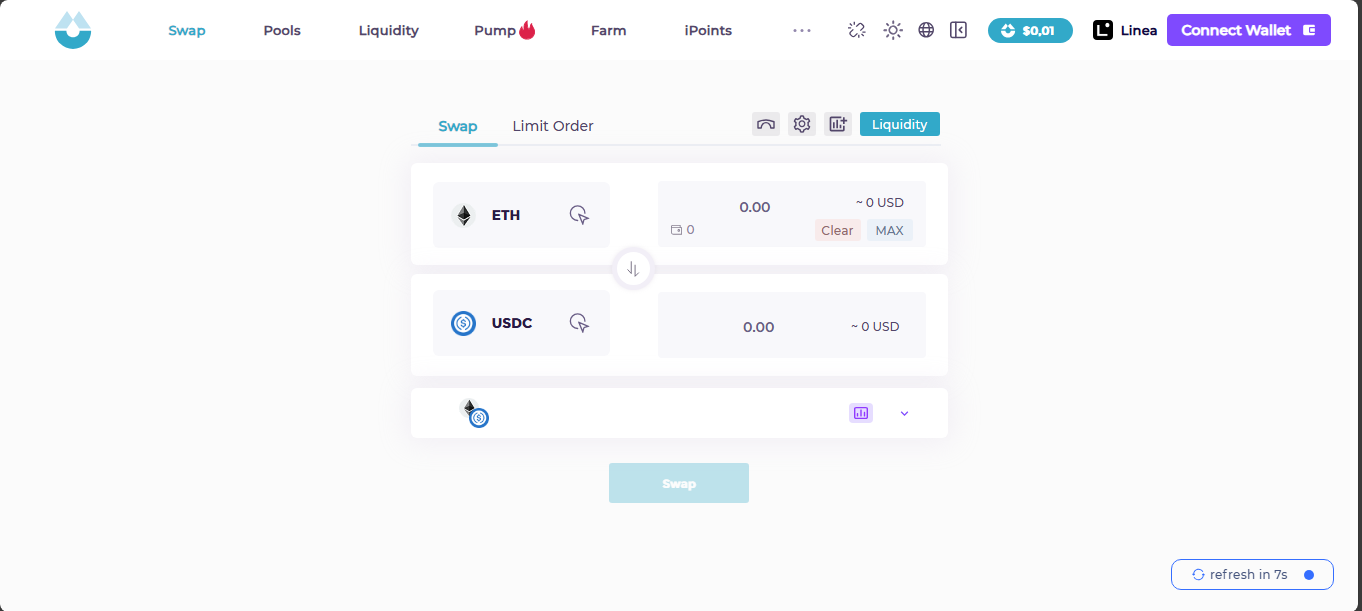

First Impressions

Connecting your Web3 wallet on iZUMi.finance gives a clean interface reminiscent of CEX order books – only it’s fully non-custodial. You get TradingView charts, cross-chain swaps, bots and limit orders – all in one terminal. No sign-up, no KYC, just plug and trade.

Key Features

Discretized-Liquidity AMM

Unlike classic AMMs that spread liquidity along a curve, iZiSwap lets providers place capital at distinct price points (ticks). This boosts capital efficiency and cuts slippage.

Zero-Slippage and Limit Orders

The DLAMM model enables perfect limit orders and zero-slippage swaps – a rare feature among DEXs. It offers more control than standard market orders.

Multi-Chain Liquidity

Originally on BNB Chain, iZiSwap has expanded to zkSync and other Layer 2s. It aims to be a universal liquidity service, aggregating assets across multiple ecosystems.

Yield Incentives

Farming is powered by “LiquidBox” pools on zkSync with dual incentives – IZI tokens plus partnered pool tokens. TVL incentives are substantial, though details are limited.

Token and Rewards

IZI is the native token used for governance and staking rewards. Total supply is 2 billion – circulating is fewer. Half of protocol fees go to token holders as income.

Volume, Liquidity and TVL

- Spot volume: around $3,230 in 24 hours

- DEX trading: around $127 in 24 hours

- Listed tokens: 5 with 7 trading pairs

- On-chain TVL: around $50K to $60K

These figures point to niche, low-scale usage. It’s suitable for small trades but inadequate for large swaps.

Trust and Security

iZiSwap is fully decentralized, non-custodial, and claims support for MEV-resistant trades. However, public audits or proof-of-reserves have not been published. Some sources classify it as high risk. No fiat or KYC pathways are available.

User Feedback

There’s limited user feedback – no visible reviews on mainstream platforms. Tech coverage praises its DEX-like experience and aggregation depth. But skepticism remains due to immature support and lack of transparency.

Pros and Cons

Pros:

- Market-style trading with zero-slippage and limit orders

- Capital-efficient discretized liquidity

- Multi-chain support and yield farming incentives

- No custodial risk or sign-up required

Cons:

- Very low volume and liquidity

- No audits or proof-of-reserves announced

- No mobile app or live support

- Fees are implicit (gas plus protocol cuts), not clearly presented

- High technical barrier for casual users

Ideal For

Tech-savvy DeFi users who want a unified interface for cross-chain swaps, bots, limits and farming. Great for trial amounts and small trades. Not for pro traders or anyone needing deep liquidity or regulatory oversight.

Final Thoughts

iZiSwap (Mode) is a purposeful experiment in AMM design and DeFi aggregation. Its discretized liquidity and zero-slippage mechanics are ahead of most protocols. But with minimal volume, little transparency, and opaque auditing, it remains a proto-platform. Ideal for exploration – but treat it like a beta app. Deploy cautiously, stay informed, and watch how its ecosystem develops.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”