KLAYswap – AMM & Cross-Chain DeFi Platform Review

Origins & Technology Foundation

KLAYswap launched in January 2021 as a decentralized exchange on Klaytn – a hybrid Layer 1 chain built for speed, low fees, and enterprise use. It debuted as an AMM-based DEX, allowing users to swap Klaytn-native tokens seamlessly, without custody risk.

Cross-Chain Interoperability & Utility

What sets KLAYswap apart is its Orbit Bridge – a transparent IBC bridge that links Ethereum-based tokens (like ETH, DAI, WBTC) to the Klaytn ecosystem. That allows yield farming with previously unavailable asset pairings.

Liquidity Mechanics & Yield-Driving Design

Anyone holding KLAY or KCT-type tokens can become a liquidity provider by depositing into pools. You earn a share of trading fees, and you can also stake your LP tokens to earn KSP – the platform’s governance token.

Governance & KSP Token Role

KSP powers the governance framework – holders can vote on fees, mining rewards, new smart contracts, and even fund new liquidity pools by paying KSP as a contract creation fee. All KSP is distributed via liquidity mining from day one.

Fees, Performance & User Experience

With Klaytn’s fast and efficient consensus (Istanbul BFT), KLAYswap delivers quick swaps and extremely low transaction fees – often just pennies. Trade fees typically follow an AMM model around 0.3 percent, adjustable through governance. The interface is user-friendly, letting any Klaytn-compatible wallet connect and trade right away.

Transparency & Risk Considerations

KLAYswap is fully non-custodial – your private keys stay secure with you, and there’s no central entity with access. The platform warns users that market volatility can influence liquidity outcomes, and mistakes like sending assets to the wrong pool are irreversible.

Strengths & Weaknesses Snapshot

Strengths:

- Instant, low-cost swaps on Klaytn

- Cross-chain asset access via Orbit Bridge

- Liquidity mining and robust governance through KSP

- Truly non-custodial with clear smart contract transparency

Weaknesses:

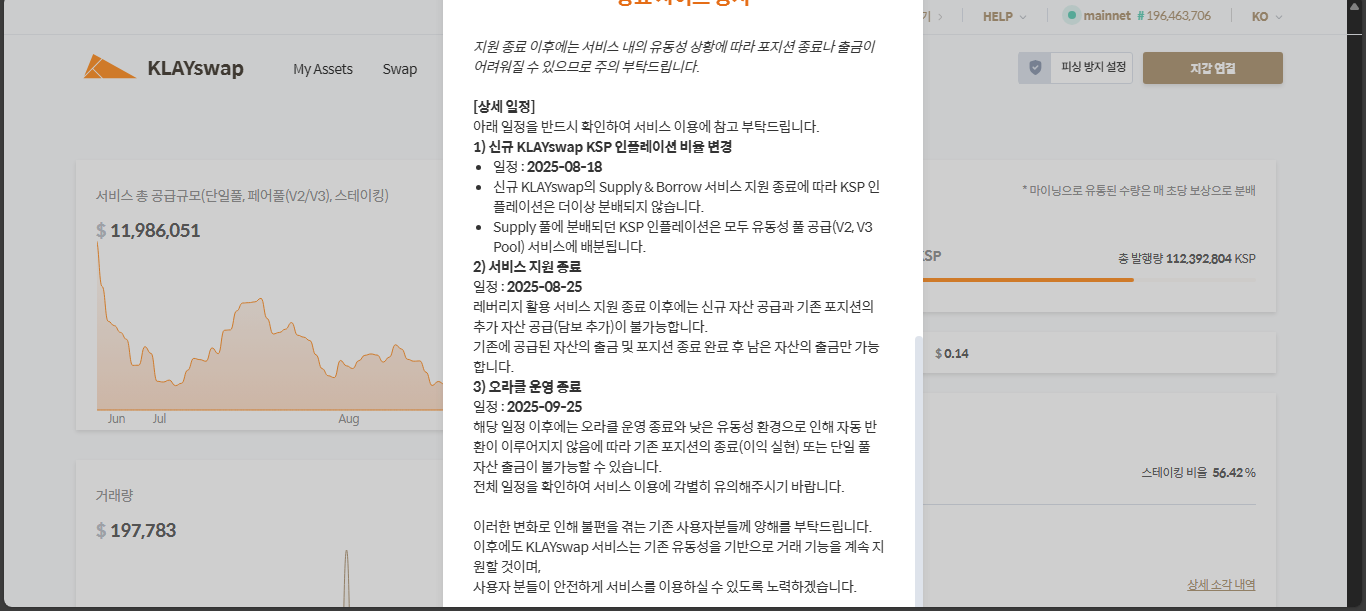

- Liquidity and volume may be limited compared to bigger AMMs

- Governance tools and token utility still developing

- Risk of impermanent loss and asset misallocation from user error

Conclusion

KLAYswap is a clean and clever DEX built for the Klaytn ecosystem. It combines AMM simplicity with cross-chain reach and compact governance through KSP. It’s ideal for Klaytn-native users, asset navigators from Ethereum, and early DeFi adopters willing to navigate a still-niche ecosystem. If you’re after speed, low fees, and on-chain control, this is a quiet corner worth exploring. But if you need deep liquidity or mainstream usability, keep an eye on how KLAYswap evolves – you may be ahead of the curve.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”