KuSwap – Exchange Review

Platform Vision and Mechanics

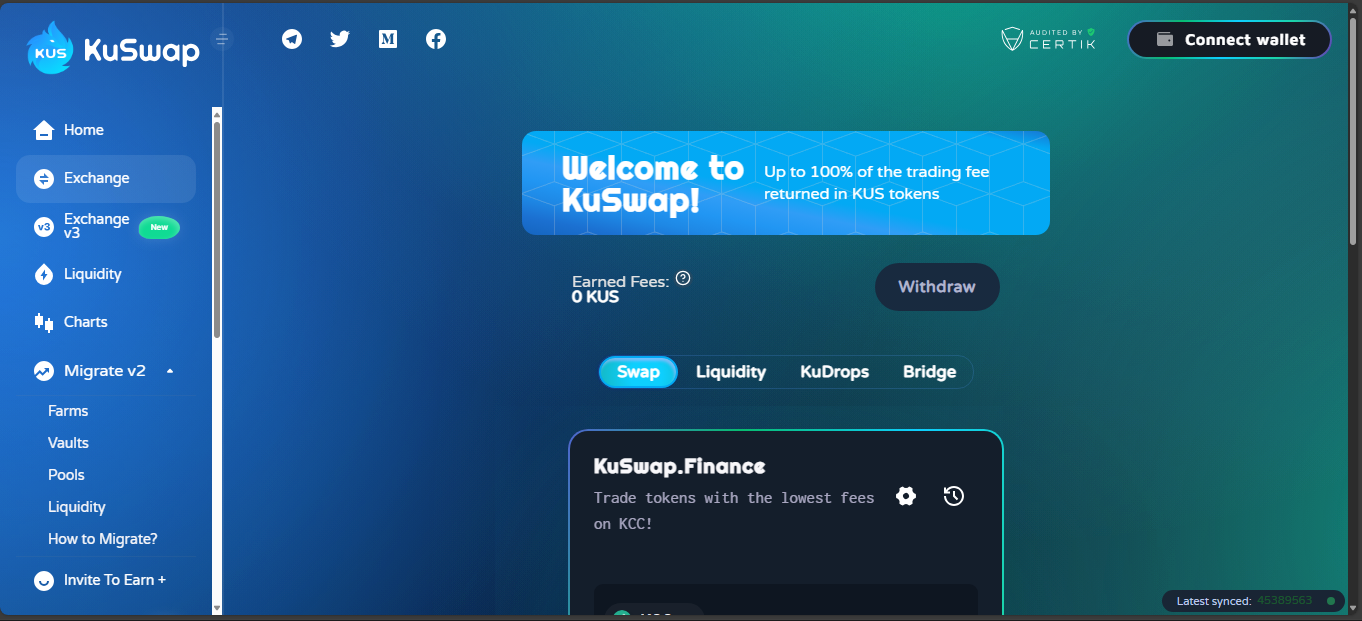

KuSwap launched in 2021 as the first AMM on KCC, aiming to be more than a swap interface. It bundled yield farming, NFTs, lending, Launchpad projects, voting via KUSDAO, insurance mechanisms, and a tucked-in governance model. Swap fees are low at 0.1% – and for trusted launchpad pairs, those fees are refunded in KUS, effectively making those trades free of charge. LPs stake tokens and earn KUS, with some of that burned and some distributed to providers. In short – it’s a full DeFi ecosystem wrapped in DeFi theory.

Flat-lined Activity, Faint Signal

If you visit trackers, KuSwap is often flagged as inactive – zero active volume, zero liquidity, zero thrill. Some data shows only 4 tokens, 8 pairs, and a staggering dip in daily volume to under 700 USD, with USDT/WKCS trading around 271 USD taking the lead. Trust score sits low.

Beyond that, web traffic sits near 300 monthly visitors. Telegram subscribers – about 2.6K. Twitter followers – about 23K. For a live DeFi system, the ecosystem is more tumbleweed than traffic jam.

Strengths vs Reality

Strengths

- Deep feature set: swap, launchpad, NFT market, farms, lending, vaults, governance.

- Ultra-low fees – even fee refunds via KUS make some trades free.

- Built natively for KCC – fast confirmations, low costs, composable.

Risks

- Almost no real action – daily volume vanishingly small.

- Low engagement metrics – weak traffic, sparse community activity.

- Ambitions > adoption – idea-rich, usage-poor.

- Token mechanics (farming, burn, refund) remain academic until people show up.

Snapshot Table

| Component | Details |

| Platform Type | AMM DEX plus DeFi ecosystem on KuCoin Community Chain |

| Features | Swap, Farm, Launchpad, NFTs, Lending, Governance |

| Fees | 0.1%, with refunds in KUS for select pairs |

| 24h Volume | ~700 USD – minimal activity |

| Token Mechanics | KUS distribution & burns via LP rewards |

| Strengths | Multi-feature design, low fees, on-chain governance |

| Weaknesses | Inactive usage, weak engagement, unproven utility |

Final Thoughts

KuSwap is like a grand, empty amphitheater – an impressive structure with little audience. The architecture is sound: DeFi tools in place, governance track ready, yield engine parked. But without users, it’s silent.

If KCC gets more attention, KuSwap could spring to life. Otherwise, it’s a DeFi mall with open doors and no shoppers. Great in concept. Empty in practice.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”