KyberSwap Classic – Exchange Review

Quick Background

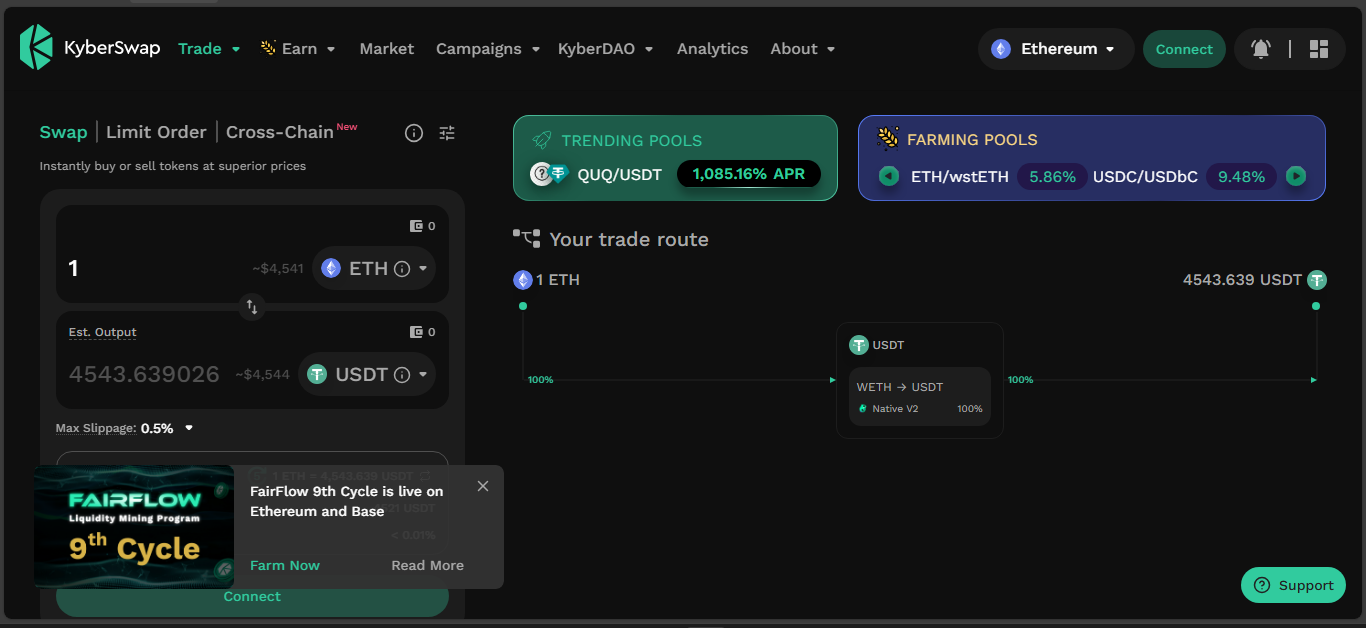

KyberSwap Classic first emerged as a token swap platform grounded in DeFi principles – a DEX-aggregator and AMM rolled into one. It brought dynamic market-making (DMM) to the scene: fees flex based on volatility, and pools include AMP curves to boost capital efficiency under the hood. It shared governance via KyberDAO, where token stakers earned fee rewards.

Market Coverage

Today, KyberSwap Classic trades in dozens of pairs on Ethereum, Polygon, Avalanche, and other chains – but active usage is sparse. Total value locked is about $1.4 million across chains, while 24-hour swap volume often drops to zero. Some recent activity on Ethereum records around $15K in daily volume across limited pairs like WBTC/USDT and WETH/USDT.

Key Stats Table

| Metric | Value |

| Launch Year | ~2018–2019 (Kyber Network roots) |

| TVL (Total Value Locked) | ~$1.4 million |

| 24h DEX Volume | ~$0–$15K (spot spikes noted) |

| Unique Feature | AMM with dynamic fees & AMP |

Trading Experience

The UI lives in DeFi roots – no order books, just AMM trades across pools. Liquidity flows are thin and irregular. Slippage can swing wide. Used well, the DMM model delivers efficient pricing – when liquidity exists.

Security and Compliance

This is open DeFi – permissionless, transparent AMM logic. Smart contracts are auditable and governed by KyberDAO. The main incident was a 2022 patch event where Polygon infrastructure was targeted – about $265K was breached from a Cloudflare key exploit.

Strengths and Weaknesses

Strengths:

- Dynamic AMM model stays adaptive to volatility.

- AMP curves help liquidity providers get capital-efficient exposure.

- On-chain, transparent, decentralized governance via DAO.

Weaknesses:

- Use has dwindled – volume and engagement are low.

- Liquidity pools feel lifeless at times – slippage risk elevated.

- No traditional regulation – DeFi-native risks apply.

Reputation and Traffic

DeFi-savvy users know KyberSwap Classic for its early innovation. But today it hums in the background. Activity, coverage, and buzz are muted compared to newer DeFi platforms.

Who It Suits

For DeFi watchers eager to explore AMP-powered AMM logic or low-key Kyber governance – it holds its niche. Traders expecting depth or constant liquidity should look elsewhere.

Final Thoughts

KyberSwap Classic is DeFi history in live form – a DMM pioneer with clever mechanics that inspired newer AMMs. Today its spark has dimmed, but the structure and logic remain for those curious about capital-efficient, dynamic liquidity design.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”