Metal X – Exchange Review

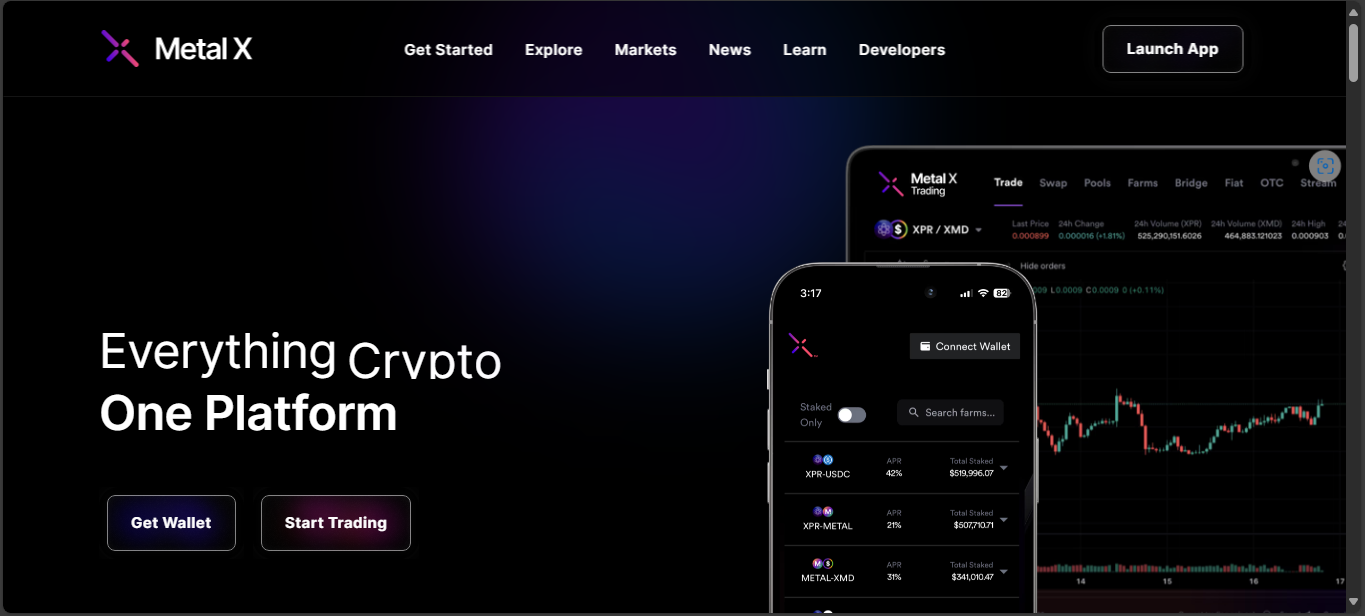

Metal X launched in 2022 as a pivot from its former centralized version, which shut down in mid-2021. The new platform runs as a decentralized exchange built on the XPR blockchain. It is smaller than most rivals but has its own style and audience.

How it started

The team behind Metal X, also known for developing WebAuth Wallet and Metal Pay, first attempted to enter the market in 2020 with a centralized exchange. That platform did not last, closing in 2021, but the experience shaped the next step: moving into decentralized finance.

The new version of Metal X was launched as a DEX built on its own XPR blockchain. Unlike the earlier centralized model, it emphasized decentralization while still trying to integrate useful tools that would appeal to both retail users and developers. Along with swaps, it introduced lending services, OTC deals, liquidity farming, and even streaming payments, which set it apart from typical decentralized platforms.

What it offers now

Metal X combines several different financial services within one ecosystem. Its main features include:

- Spot trading with order books, advanced order types, and charting tools.

- Liquidity farming with shared trading fees and token rewards.

- Lending protocols via smart contracts, letting users earn interest on assets.

- OTC trading options for larger peer-to-peer transactions.

- Streaming payments, a rare service that enables ongoing micro-transfers.

- Zero gas fees on all transactions, powered by the XPR blockchain.

This mix gives the platform a hybrid identity, combining the feel of a traditional exchange with the flexibility of decentralized finance.

Security and compliance

Metal X operates as a non-custodial platform, meaning users connect through their own wallets and maintain control of funds at all times. Transactions are handled by audited smart contracts, reducing but not removing risk.

Like most DeFi protocols, there is no insurance safety net, so users are exposed if vulnerabilities are found. An additional layer of compliance exists because KYC procedures are required. This makes Metal X unusual: it blends decentralized mechanics with a regulated access structure.

Market position now

Metal X has carved out a niche role rather than aiming to compete with top-tier exchanges. At present it lists only around a dozen trading pairs, with moderate daily volume. Liquidity in many pools is limited, which may deter high-volume traders.

Despite these limits, the platform attracts a specific audience — mainly users who already rely on the XPR network or those interested in fee-free transactions. For them, the ability to trade, lend, farm, and even use micro-stream payments without gas fees is appealing.

Pros and cons

| Pros | Cons |

| Wide range of services under one roof | Limited asset selection compared to larger exchanges |

| Zero gas fees on transactions | Thin liquidity in many pools |

| Automated tools like trading bots | No insurance, exposed to smart contract risks |

| Users keep custody of funds through non-custodial wallets | KYC required, limiting privacy |

Final thoughts

Metal X is not built to rival the largest players in the crypto exchange market. Instead, it stays focused on its strengths: combining DeFi features with a regulated layer of access and leveraging the benefits of the XPR blockchain’s zero-fee environment.

For traders and users already in the XPR ecosystem, Metal X offers an interesting mix of farming, lending, and low-cost transactions. For those seeking massive liquidity, a wide choice of coins, or anonymity, the platform may feel too narrow.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”