Meteora VD – Protocol Review

Born from Solana’s DeFi lab

Meteora traces its roots to Mercurial, a Solana DEX that stood for stable asset liquidity. Meteora VD arrived with one mission – build a dynamic yield layer that reshaped DeFi’s liquidity game. Its tech? DLMM – the Dynamic Liquidity Market Maker – and smart vaults that respond in real time to volatility and capital flows.

Keeper of LPs’ capital

With DLMM, LPs control fee ranges and liquidity concentration in real time – fine-tuning risks and yields. Add Dynamic Vaults and multi-asset pools, and you get a system that unbundles yield from swaps. Money earns yield while it stays fluid and composable – hard to touch, easy to grow.

Drama and disputes

Then came the storm. In early 2025, Meteora’s name was dragged into the LIBRA meme coin scandal – an absurd launch tied to political hype. Allegations flew around price manipulation and insider access. Co-founder Ben Chow resigned; the team launched a legal review. The drama didn’t destroy the protocol – but it shifted its energy toward cleanup and credibility-building.

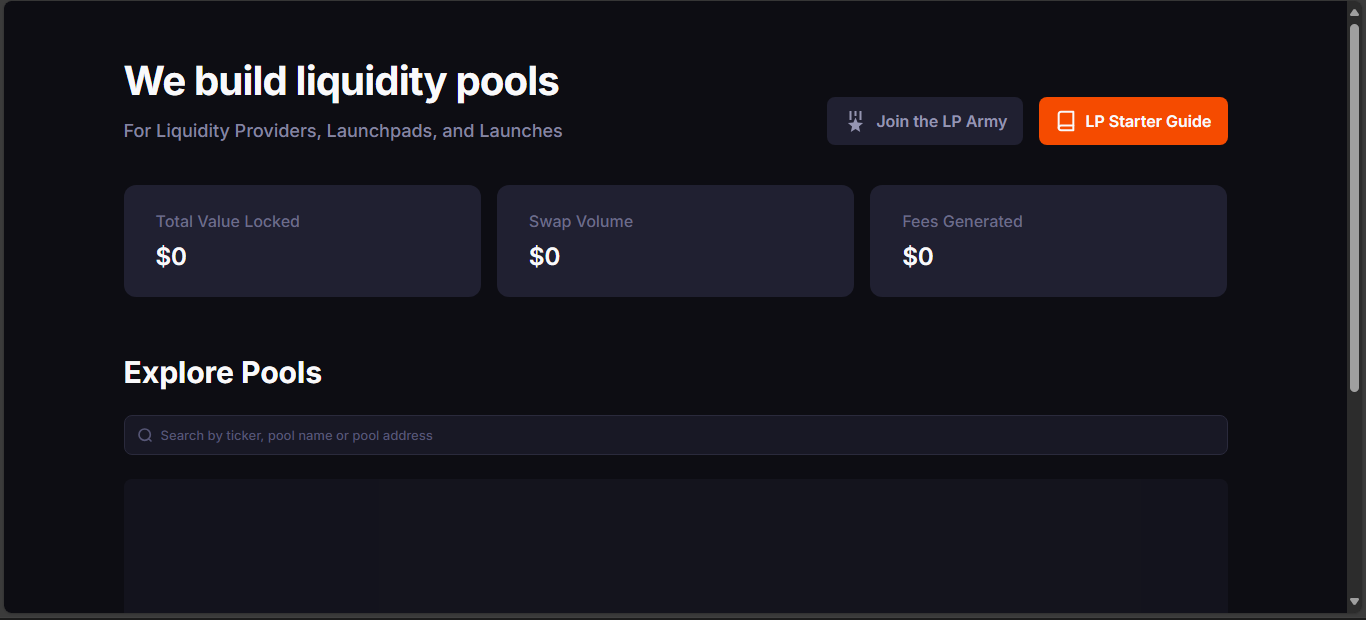

Metrics are alive – but not explosive

CoinGecko lists Meteora VD with 855 tokens and over 3,200 pairs. Daily volume sits near 300M dollars – serious, but not front-page epic. You see action – mostly in niche Solana assets, meme pools, and DeFi experiments. The UI isn’t built for mass adoption, but it’s powerful for tactical yield hunters.

Strengths vs AMDs (Areas Needing Mending)

Strengths

- Permissionless market creation – any token with a feed can have a futures-like market via DLMM

- Capital-efficient liquidity – LPs pick ranges, manage fees intelligently

- Yield+swap combos – vaults distribute yield seamlessly

- On-chain control, open dashboards, and composability across Solana ecosystem

Areas Needing Mending

- Drama cast shadows – trust needs rebuilding after LIBRA controversy

- Complexity is high – LPs need DeFi fluency to avoid losses

- Liquidity depth is narrow – big trades still face slippage

- Reputation equals traction – mass adoption isn’t here yet, and margins depend on credibility

Today’s pulse – and tomorrow’s promise

Meteora VD pulses quietly, serving LPs, quant users, and Solana DeFi fans. VCs like Chainlink-backed teams and niche developers still build on its mechanics. The protocol is rebuilding trust and usability.

If it stabilizes, adds liquidity, and stays junior-developer friendly – it could become the dynamic exchange layer everyone expects DeFi to need. But that hinges on trust recovering, vaults becoming intuitive, and liquidity deepening.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”