Niza Global – Exchange & Banking Platform Review

Introduction

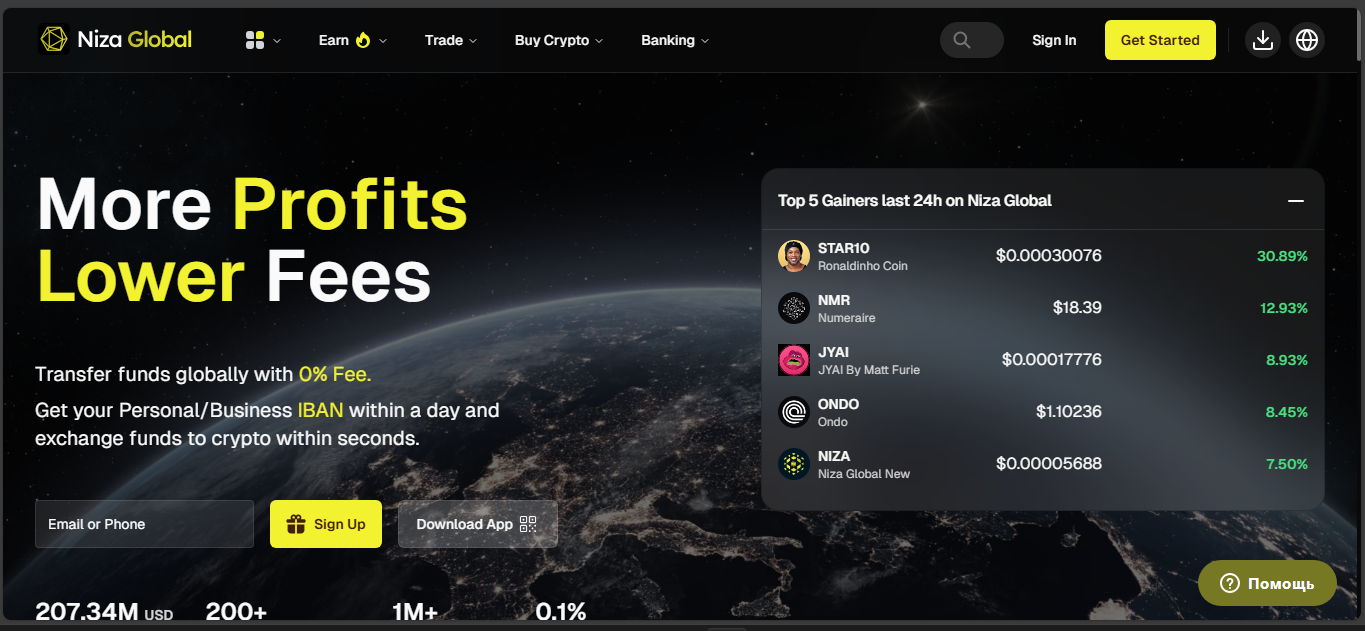

Niza Global steps into view as a fresh face in the crypto world – not just an exchange, but a full-blown financial ecosystem connecting the dots between traditional banking and digital assets. Launched around 2021, it has ambitions firmly planted in delivering both crypto convenience and real-world finance utility.

Core Services

At its heart, Niza Global aims to simplify crypto for real users. It offers a range of services from straightforward crypto trading to issuing personal or business IBANs, enabling SEPA and SWIFT transfers, and providing crypto-linked cards with generous limits for online and ATM use. Deposit fiat via SEPA, SWIFT, Visa, Mastercard, or mobile payments – it feels like a Swiss army knife of digital-fi tools.

Regulation & Security

One of Niza Global’s stronger beats is its approach to regulation. It claims regulation in Lithuania, Bulgaria and Costa Rica, plus MSB registration in the U.S. and Canada. AML and KYC are enforced – they say they work directly with local regulators to stay compliant. That level of structure is rare among crypto startups and gives the platform a veneer of legitimacy.

NIZA Coin & Staking

The ecosystem spins around the native token, NIZA. It’s an ERC-20 token on Ethereum, with a max supply of ten billion. Users can stake NIZA – stake rewards are reportedly attractive, around 35 percent APY. Some sources even mention up to 55 percent for certain programs. That’s straight yield fishing territory.

Wallets & Internal Transfers

Transfers within the Niza ecosystem are fee-free, that’s a smooth perk. If you move funds to another user on the platform – no fee eats into that. Combined with low platform fees overall, it aims to maximize your actual returns.

Mobile & Accessibility

They’ve built mobile apps on both Play Store and App Store, promising on-the-go access. Banking, trading and staking – all in one pocket tool.

Future Roadmap

Niza isn’t resting. They’re talking about unveiling a decentralized exchange (DEX) and launching their own blockchain, Niza Chain. Those are big-ticket features that could transform the platform into a DeFi-style ecosystem beyond its current centralized banking-exchange hybrid.

Token Economics & Market Data

Here’s how NIZA stacks up on the charts today: the coin trades around $0.000065, with a circulating supply roughly 7.69 billion out of 10 billion max. Market cap hovers around $500,000 – small-cap territory. Daily trading volume sits in the low six-figure range. The price has tanked almost 99.8 percent from its all-time high in early 2024 but is up slightly from its early-2025 low.

Why it matters: small market cap means volatility and risk, but it also means leverage – if something positive happens, price could swing big. Just don’t be surprised by swings.

Strengths & Weaknesses at a Glance

Strengths:

- Unique blend of banking + crypto exchange

- Regulated footprint across multiple jurisdictions

- High-yield staking on native token

- Fee-free internal transfers plus competitive fiat options

- Mobile app brings full functionality on the go

- Roadmap includes DEX and blockchain launch

Weaknesses:

- NIZA coin is highly speculative – tiny market cap, huge price drop

- Trust depends heavily on claims of regulation – third-party validation scarce

- Tokenomics vague – unclear distribution and emission schedule

- Users may face uncertainty around actual APY vs marketing claims

- Ecosystem still emergent – DEX and chain are future promises, not live today

Conclusion

Niza Global is bold – a banking-compatible exchange wrapped in a crypto layer. Its regulatory posture, IBAN offerings, fiat-on/off ramps and bank card integration give it a polished veneer. Yet the real kicker is NIZA staking yields and aspirations toward DeFi expansion.

Whether Niza becomes a trusted bridge between traditional finance and crypto depends on execution. Right now it’s a compelling concept and a risk-heavy opportunity. If you like experiment-in-progress, and you’ve got a taste for yield and bleeding-edge innovation, it might be worth a look. Just buckle up – it’s the wild side of crypto-banking convergence.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”