Nostra – Exchange/DeFi Protocol Review

What is Nostra

Nostra is a DeFi super app built on StarkNet, designed to combine swapping, lending, borrowing, liquid staking, bridging and a native stablecoin into a unified interface. It positions itself as a one-stop hub for users who don’t want to juggle multiple dApps.

Core Features

- Non-custodial lending and borrowing

- Liquid staking with nstSTRK

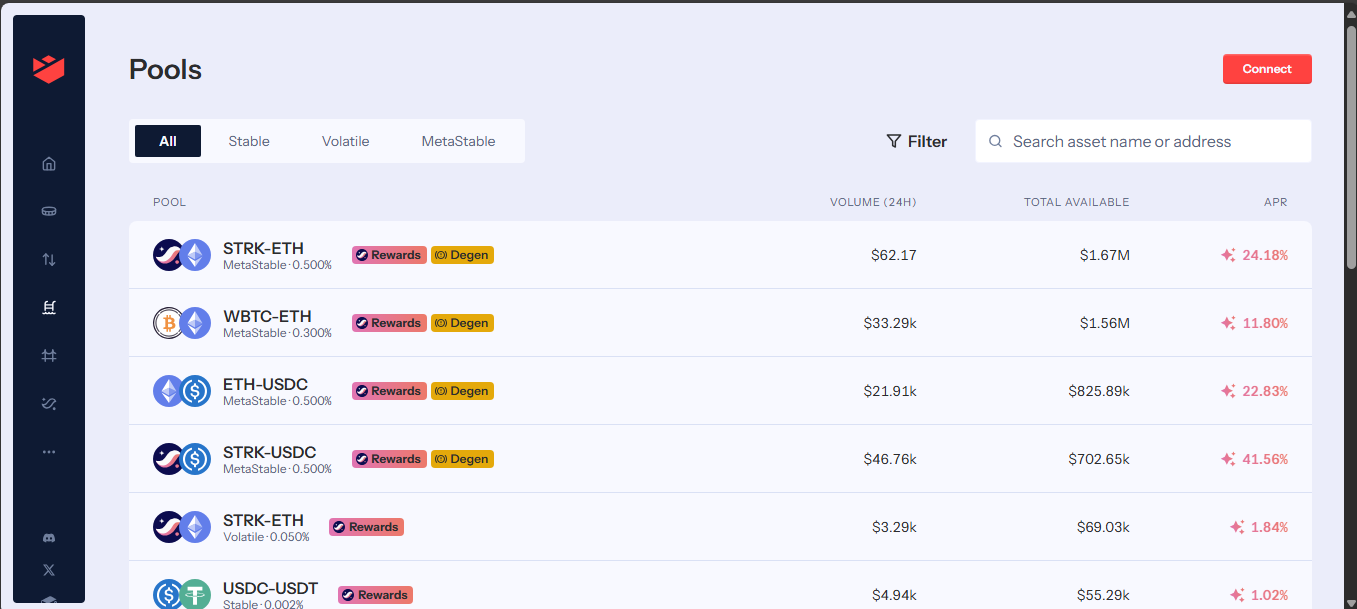

- On-chain swap interface via Nostra Swap orderbook

- Bridge to 20+ chains

- UNO stablecoin pegged to USDC

- Multi-account wallet management

Token – NSTR

The NSTR token is the native token used for governance and to power the platform’s DAO. It launched via an unlocked model, with 100 million tokens in circulation. Backers include notable firms like StarkWare, Jump Crypto, Wintermute and Lemniscap.

TVL and Adoption

Nostra sits among the top DeFi protocols on StarkNet, with around $55 million to $211 million in TVL depending on source – roughly 10 to 40 percent of StarkNet’s total activity. NSTR trading volumes are modest at $110k daily, and the token price sits near $0.024.

Security & Transparency

Nostra’s smart contracts underwent audits from firms like Trail of Bits and Hats Finance. However it faced a critical price feed issue in March 2024 that inflated liquid staking asset prices, forcing a pause on borrowing. Since then, the platform has improved oracle redundancy and risk safeguards.

Code is open-source, and the app is live on mainnet with growing usage. There’s no public bug bounty program noted, but audits and fixes are on record.

Pros and Cons

Pros:

- All-in-one DeFi super app on StarkNet

- Strong TVL and community backing

- Native UNO stablecoin, liquid staking and bridge

- Verified audits and responsive oracle fixes after incidents

- Backed by solid institutional investors

Cons:

- Price feed exploit showed vulnerability

- Total adoption still mid-range compared to major L2 protocols

- Some features like bridge and swap may lack full maturity

- Smart contract complexity and governance adds learning curve

Who it suits

Nostra is built for DeFi users who want a unified experience – lending, swapping, staking and multi-chain transfers – all in one place. It’s great for experienced users curious about Layer 2, liquid staking and DAO governance. It’s less suitable for beginners or anyone needing ultra-simple apps.

Final verdict

Nostra is one of the more ambitious and complete DeFi ecosystems on StarkNet. It stands out by combining core features like lending, staking, swap, bridge and governance with institutional backing and transparent audits. The protocol handled setbacks responsibly and remains a top contender for Layer 2 DeFi users.

If you’re looking to dive into StarkNet with serious functionality – not just a DEX – Nostra is a compelling choice. Just be aware of oracle risks and smart contract complexity. On balance, it punches above most L2 DeFi offerings.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”