Pangolin – Exchange Review

Quick Intro

Pangolin is not just another DEX – it is Avalanche’s homegrown decentralized exchange with a community-first DNA. Since its 2021 debut, it has evolved into multichain territory, fueled by transparent governance, real innovations like concentrated liquidity, and a full DeFi toolkit.

Snapshot Recap

| Feature | Insights |

| Launch and Growth | Live since 2021 on Avalanche, now multichain-aware via V3 |

| Core Offerings | Swaps, farming, PNG-governed DAO, limit orders, and interchain liquidity |

| Fee Model | Dynamic, adjusts to volatility – optimized for trading and LP efficiency |

| Token Utility | PNG is 100% community-distributed; holders stake and steer protocol |

| Scale and Reach | ~190K 24h volume, 41 assets, 53 trading pairs, ranked mid-tier DEX |

Deeper Look

Why It Roots

It sprang from Avalanche’s ecosystem, offering rapid, cheap swaps and native DeFi tools. Built with community integrity – no insider token dumps, full transparency, and governance that lives in votes, not boardrooms.

How It Stacks Up

- Pangolin V3 unleashed concentrated liquidity, dynamic fee tiers, and smart range orders – bringing Uniswap V3-style innovation to Avalanche and beyond

- Transparent upgrades, audits, community proposals – it is both innovative and open

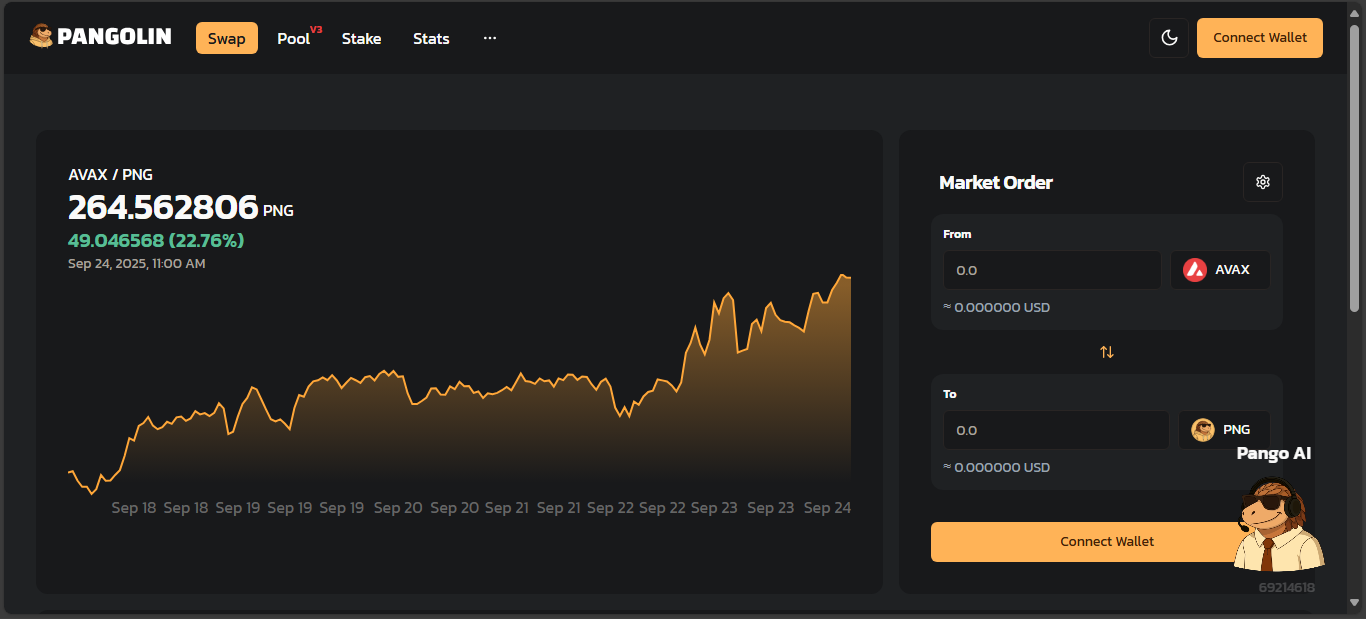

Activity Pulse

Recent metrics report ~193K in 24h volume, roughly 41 tokens and 53 trading pairs. That puts Pangolin solidly in mid-tier DEX territory.

Governance in Action

PNG token powers governance – distributed entirely to users, no pre-mines. Holders stake for protocol fees and vote on updates. That is community control – unusual in DeFi.

Watchpoints

- Volume lags behind top-tier DEXs – expect slippage and limited liquidity in some pools

- Still Avalanche-leaning – growth across chains looks good on paper, but usage remains concentrated

- Dynamic fees complicate calculation – but they are fairer and more adaptive

What Makes It Shine

| Strength | Why It Matters |

| Community governance | True user control, no insider advantage |

| V3 innovation | Capital-efficient liquidity and smarter trades |

| Multichain design | Expands access beyond Avalanche blocking walls |

| Full DeFi stack | Swap, farm, stake, limit orders – all dApps in one |

Who It Suits

DeFi strategists who want transparency, governance power, and efficient liquidity tools – especially those already in Avalanche or multichain builders. Not for quick-setup CEX traders or fiat-first users.

Final Take

Pangolin hits the sweet spot between community control, innovation, and actionable DeFi tools. It is not the flashiest – but it is resilient, evolving, and built by its users. If you want DeFi to feel both functional and future-forward, Pangolin deserves a place in your session.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”