PointPay – Exchange Review

Ecosystem at a glance

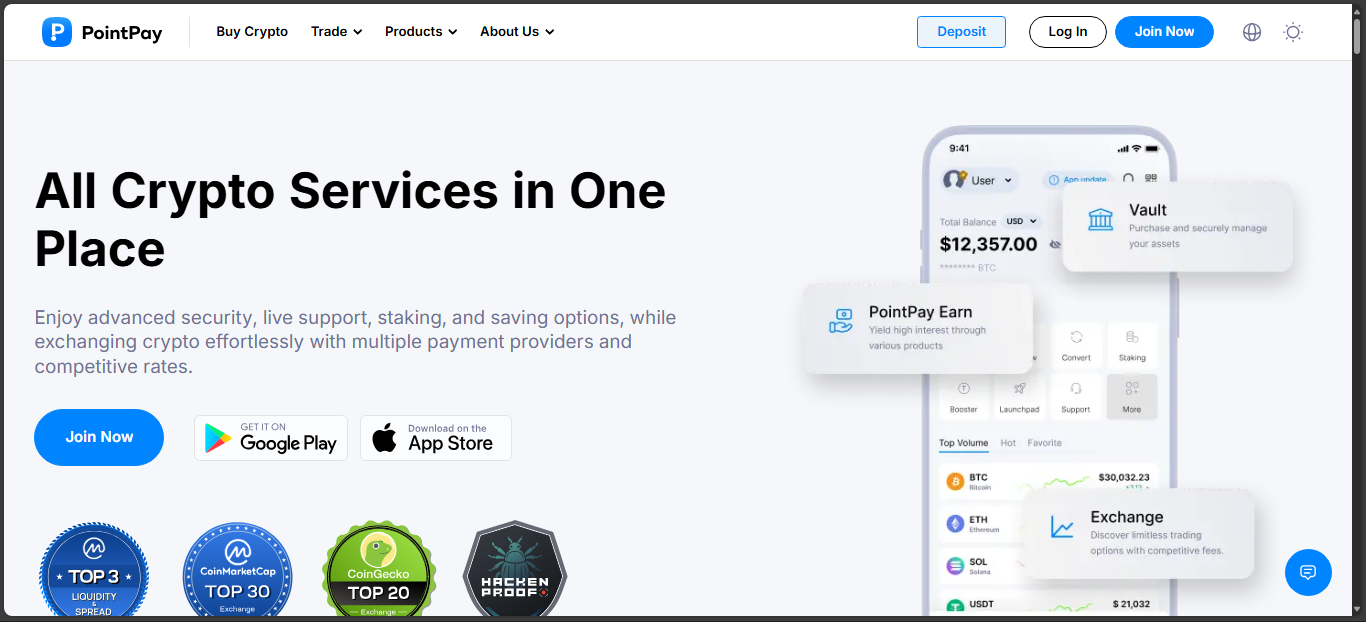

PointPay is a hybrid platform spread across St. Vincent & the Grenadines, Estonia and Lithuania, serving over a million users. It combines banking features with crypto trading via a unified interface and supports fiat flows, staking, loans and token launch participation.

Its exchange offers three interface modes – Classic, Advanced and Quick Exchange – to suit both novices and pros, wrapped in a turnkey, bank-style design.

Trading activity and pair depth

Reported 24-hour volume sits around $800 million – a solid figure for a regionally focused exchange. It lists 156 coins and nearly 200 spot pairs, including popular ETH/USDT, BTC/USDT, BNB/USDC and ADA pairs. Liquidity is decent at scale, but still limited on less common tokens.

Fees, rewards and token utility

Trading comes with a flat 0.05% maker-taker fee – competitive by global standards. Holders of the native PXP token can score up to 35% off those fees. Deposits and internal transfers are free, while withdrawal costs remain low.

Beyond trading, users earn up to 8% APY in the PointPay crypto bank on assets like USDT, USDC and DAI. PXP staking can yield up to 20% a year, scaled by lock-up duration. It’s a system designed to reward both savers and loyalists.

Fiat access and lending services

Fiat on-ramps support USD, EUR, GBP and other currencies through debit/credit cards and bank transfers. The platform also offers instant crypto-backed loans with streamlined collateral workflows – no credit checks, quick access to funding.

Interface and experience

The UI is clean and responsive, with mobile and web platforms offering clear order books, charts and wallet flows. Quick Exchange provides a simplified buying route, while Advanced mode caters to serious traders. Banking features are integrated but don’t clutter the display.

Regulation and security posture

PointPay operates with a Lithuanian license (via UAB Point Pay EU), adding regulation to its international reach. The platform touts military-grade encryption and 2FA, plus a unified wallet and banking backend. Public proof-of-reserves or audit documents are not visible, though trust metrics like CoinGecko’s show a 7/10 trust score – middling but measurable.

Strengths and weaknesses

Strengths

- Comprehensive ecosystem bridging crypto trading, finance and blockchain services

- Fiat access and crypto instruments all in one wallet

- Competitive fees and strong rewards via PXP staking and discounts

- Licensed framework and centralized control cater to cautious users

- Multiple UI options support a spectrum from beginners to advanced traders

Weaknesses

- Transparency gaps – reserves and audits aren’t public

- Most activity appears regional – global impact remains modest

- Lending and yield elements may not be available everywhere due to regulations

- Trust is functional, not exceptional – platform still building brand equity

- Advanced traders may find depth lacking on certain altcoin pairs

Final word

PointPay is a bold attempt to unify banking and crypto – delivering trading, earn, loan, wallet and payments under one roof. With regulatory backing, a million users and reward programs built in, it’s a strong choice for users in aligned jurisdictions.

Yet it stays rooted in regional markets. For crypto users seeking broad compliance, yield and convenience, it offers a compelling one-stop gateway. For global traders chasing deep liquidity or open-source transparency, it still needs to prove itself beyond its current geography.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”