PulseX – Exchange Review

Snapshot – At a Glance

PulseX is not about flashy ranks – it is built low-key, efficient, burning tokens with every swap. Volume is modest, but it quietly generates millions in fees and revenue. It runs lean, focused on deflation and participant rewards.

| Feature | Details |

| Network | PulseChain DEX using PRC20 tokens |

| Fee Structure | Around 0.25–0.29% per trade |

| Deflation Model | 20–25% of fees used to buy and burn PLSX |

| 24h DEX Volume | Around 1.7m–2.4m USD |

| Revenues (24h) | 60k–100k USD from trading fees |

| Annual Fees | Around 29m USD from user trades |

| Token Distribution | No ICO – token allocated via sacrifice, LP incentives, DAO |

| Governance | PLSX holders vote on liquidity pair incentives via DAO |

How PulseX Works

PulseX is a DEX on PulseChain that functions like Uniswap – but with built-in deflation. Every swap has a fee, and a share of that fee is used to buy PLSX and burn it. That cuts supply while rewarding holders.

Liquidity providers can stake PRC20 tokens or bridge in ERC20 assets. They earn standard LP fees and may boost rewards through farming incentives. The DAO lets PLSX holders decide which pools receive incentives. This model ties governance, tokenomics and liquidity together in a single system.

Strengths of PulseX

- Deflation in action: every swap cuts circulating supply.

- Consistent revenue: millions in daily trades generate real fees.

- Incentives for LPs: fees, staking rewards and DAO influence.

- PulseChain-native: low-cost and fast swaps on a scaled Ethereum fork.

- Community control: DAO votes shape pool incentives and distribution.

Risks and Limitations

- Volume volatility – burns and rewards depend on daily activity.

- Founder controversy – background issues cast a shadow over adoption.

- DAO hurdles – governance can be dominated by large holders.

- Token supply scale – trillions of tokens mean burns reduce, but do not erase, supply pressure.

- Limited appeal – PulseChain is still niche compared to Ethereum or BSC.

Community Vibe

Within its ecosystem PulseX is treated as the default DEX. Users see it as the backbone for PRC20 swaps. Community feedback highlights low fees and fast execution, while also noting that onboarding through wallets and bridges can feel technical. The main appeal lies in token burns and the idea of a deflationary system supporting long-term holders.

User Mechanics in Real Terms

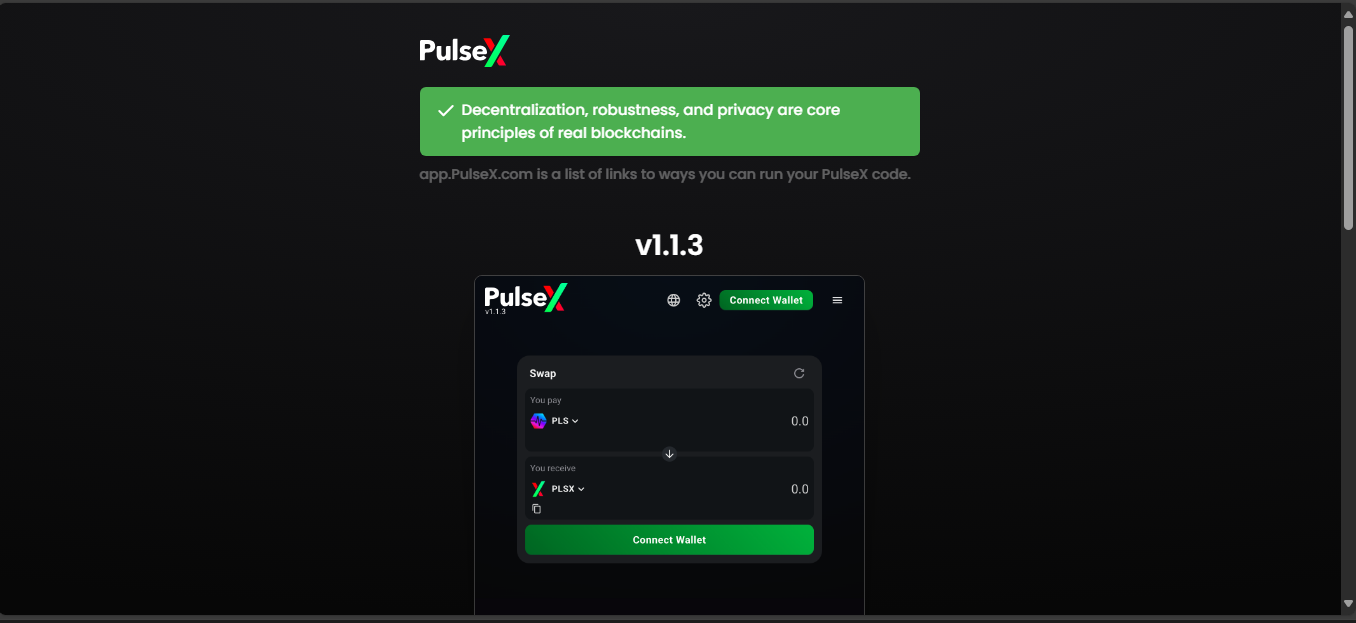

Using PulseX is straightforward. Connect a wallet, choose PRC20 tokens, confirm the swap, and a fraction of the fee automatically burns PLSX. Liquidity providers earn fees and additional tokens through incentive programs. Staking options layer further rewards. The DAO gives token holders the ability to vote on how incentives are allocated.

Final Takeaways

Why PulseX attracts attention

- Deflationary tokenomics integrated into every trade.

- Daily revenues measured in tens of thousands.

- Low-cost environment powered by PulseChain.

- Community-driven through DAO incentives.

Why caution is advised

- Liquidity is not deep for large positions.

- Governance may tilt toward whales.

- Regulatory uncertainties around the broader ecosystem.

- Adoption beyond PulseChain remains limited.

PulseX is more than just a fork of Uniswap. It is a deflation-driven DEX that burns supply with every transaction and rewards liquidity providers with fees and influence. For traders committed to PulseChain, it is a core tool. For outsiders, it looks experimental but carries the seeds of a unique deflationary model in DeFi.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”