SushiSwap on Arbitrum – Exchange Review

1. SushiSwap scales to Arbitrum – why it counts

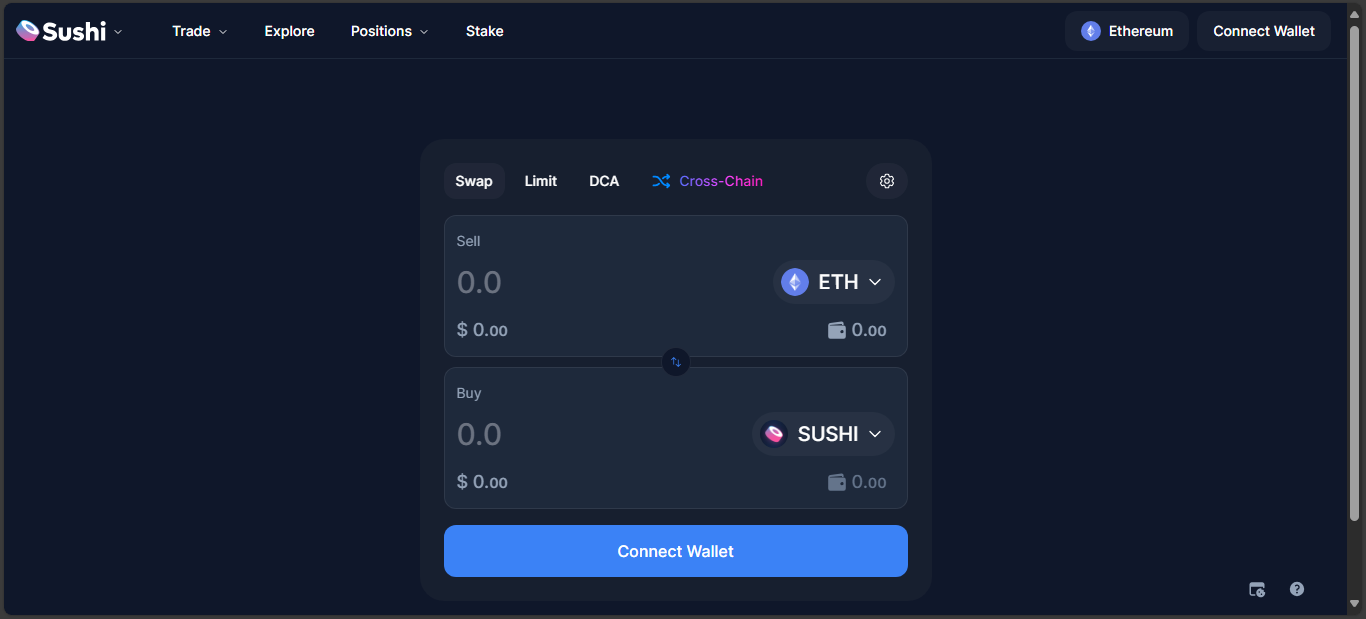

SushiSwap on Arbitrum is not a novelty – it’s SushiSwap bringing its full DeFi arsenal onto a faster, cheaper layer. AMM swaps, BentoBox vaults, Kashi lending, token farms and governance – all wrapped in low-gas Arbitrum access. DeFi power without Ethereum’s toll.

2. What you get – Sushi features on Arbitrum

Sushi’s DeFi tools move to L2 seamlessly:

- Permissionless token swaps with reduced gas costs.

- Liquidity pools feed BentoBox, Kashi and MasterChef, now with Arbitrum efficiency.

- Farms and staking remain – earn SUSHI or xSUSHI on new chain volume.

- Governance stays intact – vote via SUSHI, engage with Sushi DAO, now on Arbitrum.

Fx-like depth – same DeFi tools, faster and cheaper.

3. Where users benefit – and still hesitate

Why traders stay:

- Significantly lower fees and faster blocks than Ethereum.

- All Sushi features available, without ETH-level congestion.

- Seamless wallet experience if you already use Arbitrum.

Yet:

- Liquidity and volume often trail Ethereum or Polygon versions – slippage and thin books show up.

- Cross-chain bridging adds steps – not as instant as native Arbitrum liquidity pools.

- New risk surface: smart contract migration from Ethereum to Arbitrum introduces subtle security gaps.

4. Sushi-Arbitrum’s role in DeFi landscape

Think of it as a bridge: Ethereum-grade features, Layer-2 speed. It matches SushiSwap’s full DeFi design with Arbitrum’s performance – trading, yield, governance, all under one roof. Best part – one wallet, many chains; toggle your DeFi mode.

5. Strengths vs Limitations

Strengths:

- Fast, low-cost trading atop Sushi’s ecosystem.

- Full suite of tools – swaps, farming, lending, governance – intact.

- Arbitrum’s UX and segmentation make DeFi smoother.

Weaknesses:

- Trade volume and liquidity still smaller than mainnet counterparts.

- Slightly more complexity – bridging, chain toggling, and contract security nuances.

- Still layered – any L2 depends on security of its yet-uneven infrastructure.

6. Lessons from SushiSwap Arbitrum

- Layer-2 is where DeFi meets practicality – speed without stripping features.

- Ecosystem consistency matters – full feature parity builds trust among users.

- But migrating smart contracts demands awareness – different environments carry hidden risks.

7. Final verdict

SushiSwap on Arbitrum blends DeFi depth with L2 agility. Active DeFi users get nearly frictionless swaps, farming, lending and governance – minus Ethereum’s gas hang-ups.

If you’re mobile-savvy on Arbitrum, this is your DeFi toolkit. If you’re new to DeFi or volume-driven trades, traditional channels may feel more fluid. But for those already living L2, SushiSwap on Arbitrum nails the blend of speed, utility and entire feature stack – all in one place.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”