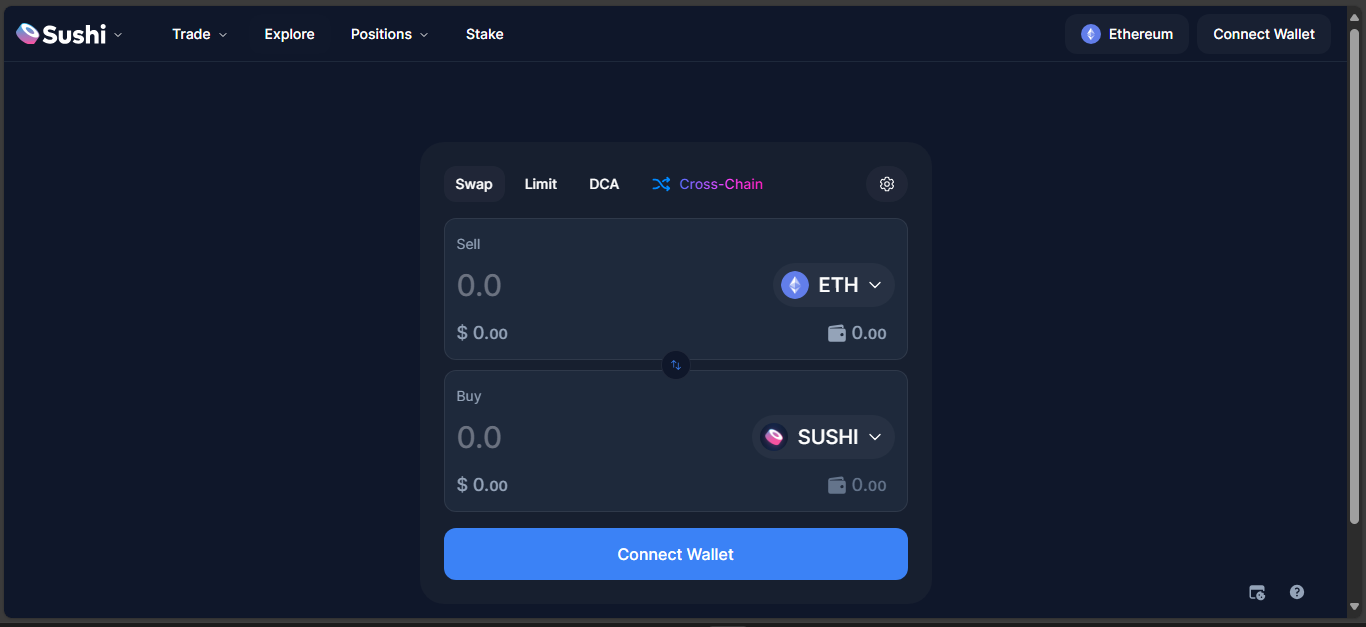

SushiSwap (Polygon) – Exchange Review

Origin

SushiSwap emerged in 2020 as a fork of Uniswap, adding community governance and liquidity rewards with SUSHI tokens. It expanded aggressively across dozens of chains, arriving on Polygon with low-cost swaps, multi-chain aggregation, and AMM flexibility baked in.

Expansion

By 2023, SushiSwap on Polygon launched via SushiSwap V3, offering concentrated liquidity, multi-fee tiers, and cross-chain swap routing. Polygon’s low gas fees and fast confirmations made Sushi’s tools accessible without Ethereum’s cost barriers – luring users into farming, staking SUSHI, and using SushiBar to earn trading fees as xSUSHI.

Activity

Currently, SushiSwap (Polygon) shows a 24-hour trading volume around 163,960 USD (≈2 BTC). Liquidity varies by pool – but for example, one V2 WETH/nDEFI pool shows about 35k USD in TVL and negligible daily volume, just a few dollars. Overall, Polygon volumes are pocket-sized for a DEX, serving niche users rather than mass trading activity.

Risks & Strengths

Strengths

- Low-fee Polygon swaps make AMM access efficient and cheap

- Concentrated liquidity and tiered fees offer capital efficiency for LPs

- SUSHI token used for governance, staking, and fee rebates extends DAO mechanics

- Multi-chain support with smart routing improves rate execution

Risks

- Very low volume limits trade depth and increases slippage risk

- Thin liquidity leaves pools vulnerable to large trades or front-running

- Protocol complexities (V3, SUSHI incentives) may overwhelm new users

- Polygon dependency means network congestion or outages impact usability

- Limited visibility – few active pairs and sparse usage data raise caution

Final Verdict

SushiSwap on Polygon is functional, efficient, and aligned with DeFi enthusiasts and Polygon devotees. It brings core Sushi mechanics – liquidity rewards, governance, multi-chain reach – into a low-cost environment. That said, it’s tiny compared to main DEX traffic. If you’re in the Sushi ecosystem already, enjoy farming or governance, or need low-gas swaps, it works well. For serious traders or liquidity seekers, it’s too quiet, too small, and yet to prove itself as a scalable DeFi hub.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”