SushiSwap v2 – Exchange Review

Snapshot – At a Glance

SushiSwap v2 (Base) is not here to dominate charts – it’s quiet, niche and mostly idle. No flashy traffic, no hype streaks, just a tucked-away DEX for curious Base users.

| Feature | Details |

| Launch Year | 2023 |

| Chain | Base (Layer-2 by Coinbase) |

| Model | Standard AMM swap DEX |

| Tokens and Pairs | Around 20 coins, 27 trading pairs |

| 24h Volume | 110,000 USD (recent snapshot) |

| Activity | Sparse – some pairs with zero trades in hours |

| Trust and Scale | Low – under the radar aggregation |

Backstory and Mechanism

SushiSwap v2 (Base) showed up in 2023 as part of Sushi’s push onto emerging networks. Built using the same AMM model – buckets of liquidity, token swaps without order books – it was meant to bring decentralized trading to Coinbase’s L2.

But unlike its Ethereum or Polygon siblings, this version went light. No aggressive listing rollouts, no developer fanfare – just passive presence where Base users could swap if they wanted.

Where It Shines

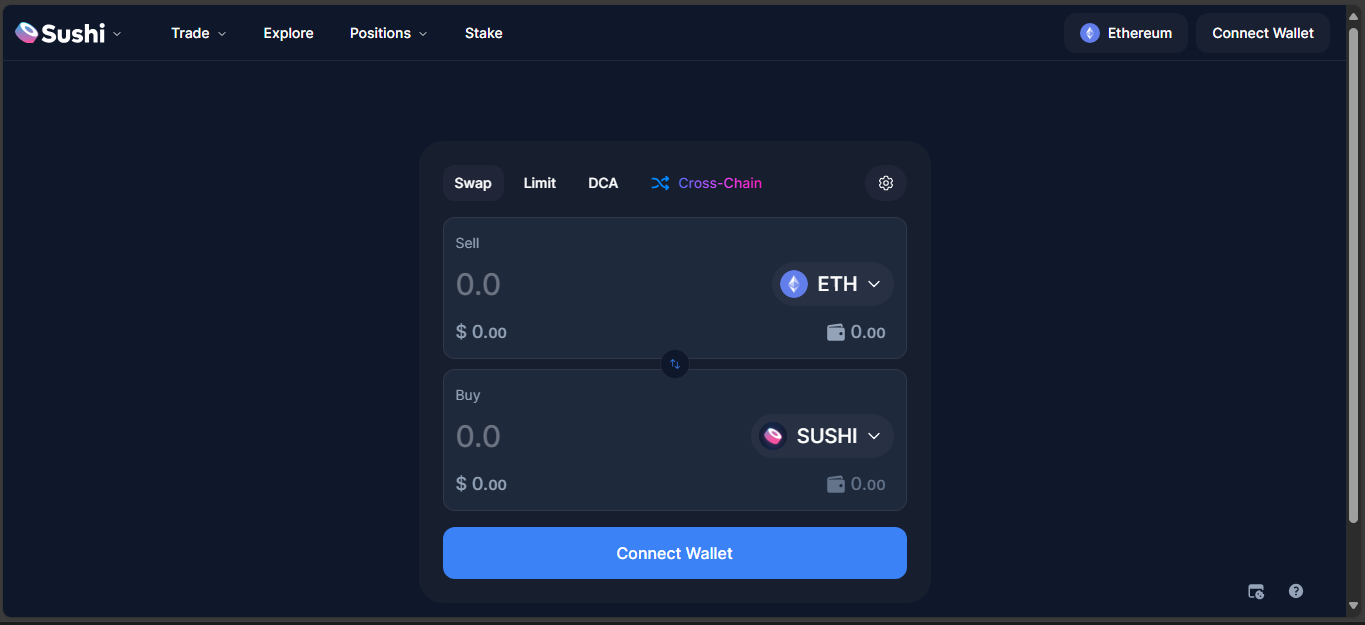

- Lightweight AMM interface – familiar to Sushi users, easy to use

- Low fees, simple swaps, and no entry friction beyond wallet

- Experimental space for Base – early mover advantage if Base grows

- AMM without custody, fully non-custodial swaps and liquidity

Weaknesses and Risks

- Very thin liquidity – expect slippage if you try serious trades

- Almost no volume – most pairs sit idle, some silent for hours

- Limited awareness – hardly any coverage or buzz around the product

- No farming, staking, or token incentives active on this chain – minimal rewards

- Functionally feels abandoned unless Base takes off fast

User Feel – What It’s Like

You connect your wallet, open the swap UI, pick a token pair – any. Some swap, most sit. No confirmations of farming or yield. It’s an arcade test, not a launchpad. For a few, it’s a playground; for most, a quiet corner.

Final Takeaways

Why it matters

- SushiSwap presence on Base shows early-chain experimental outreach

- AMM works, UI is familiar, no fuss for those already in the Base ecosystem

Why to be cautious

- Liquidity is minimal – swaps are theoretical for serious volume

- No native incentives – token utility or rewards aren’t flowing here

- Activity rests almost entirely on Base adoption – otherwise, it’s ghost town status

SushiSwap v2 (Base) is less of a bustling DEX and more of a soft landing earlier in an experimental zone. For Base die-hards, it’s a tidy tool in your belt. For everyone else, it’s a dormant promise that may or may not wake up soon.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”