SwapBased – Exchange Review

Snapshot

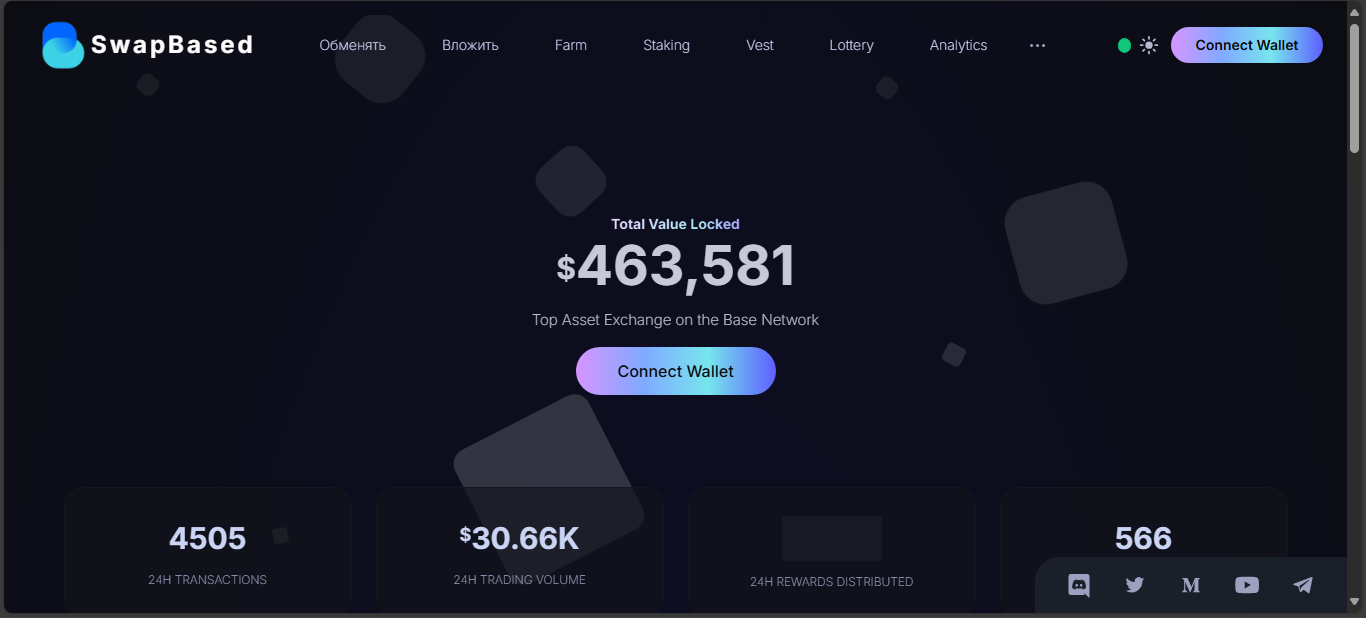

SwapBased is a decentralized exchange launched in 2023 on the Base blockchain. It combines swaps, concentrated liquidity, single staking, crossing chains, and perpetuals in one protocol. With only six tokens and seven trading pairs, it’s promising but still tiny in activity.

First Impressions

The interface feels polished, blending the familiarity of a CEX order book with on-chain operation. You connect a wallet – no sign-up – and can trade, stake or add liquidity. It positions itself as the Base ecosystem’s go-to DEX.

Key Features

All-in-one DeFi Toolset

- Swaps: ERC‑20 instant trades with ~0.30% fee that goes back to LPs

- Concentrated Liquidity: Earn high fees by adding liquidity within custom price bands

- Farms and Staking: Stake tokens to earn protocol rewards

- Perpetuals: The first DEX on Base to offer perps trading

- Cross-Chain Bridge: Supports bridging for token movement across networks

Market Size and Liquidity

- TVL stands around $544K, with $533K on Base and $10K on other chains

- DEX volume was $345K over 24 hours, $2.47M last 7 days, and $10.9M monthly

- Fees roughly $98 in the last 24 hours, adding up to $25K+ annually from protocol earnings

- Some sources report lower volume – between $16K and $38K daily

Token and Rewards

SWAPBASED’s governance or reward token provides community fee sharing. LPs get direct returns from swap fees. Single staking also earns protocol rewards, though reward rates aren’t fully clear yet.

Security and Transparency

The protocol uses immutable smart contracts on Base – its non-upgradeable nature boosts security trust. However, no external audit or formal proof-of-reserves is public, putting it in a “use with caution” category.

Pros and Cons

Pros:

- Full toolset: swaps, concentrated liquidity, perps, staking, bridges

- First mover on Base with perpetuals and advanced liquidity features

- Solid TVL and volume trajectory for a new protocol

- Wallet-based, no custody, no KYC

Cons:

- Limited token variety and trading pairs (6 tokens, 7 pairs)

- No independent audit or reserves proof

- On-chain fees not always transparent

- Interface complexity may overwhelm casual users

- Perps feature still in beta, with low liquidity

Who It’s For

Experienced DeFi users seeking to experiment on Base would enjoy advanced features and tight NFT-like capital efficiency. It’s suitable for medium-sized trades – big enough to benefit from concentrated liquidity, not so large it causes slippage. Not ideal for beginners or for institutional scale due to limited market depth.

Risk Signals

Lack of audits and public security proof is a major red flag. The protocol fees and volume are growing, but the total financial runway is modest. The platform still seems in early development stages.

Final Word

SwapBased brings a compelling mix of AMM innovation, farming, staking, and perpetual markets to Base. Its featured liquidity tools and protocol integration are forward-looking. Yet, limited liquidity, asset choice, and absence of formal security audits mean it’s best treated as a well-built beta. Try small, monitor development, and watch for audits or protocol upgrades.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”