Swop.fi – AMM & DeFi Platform Review

Core Concept & Blockchain Backbone

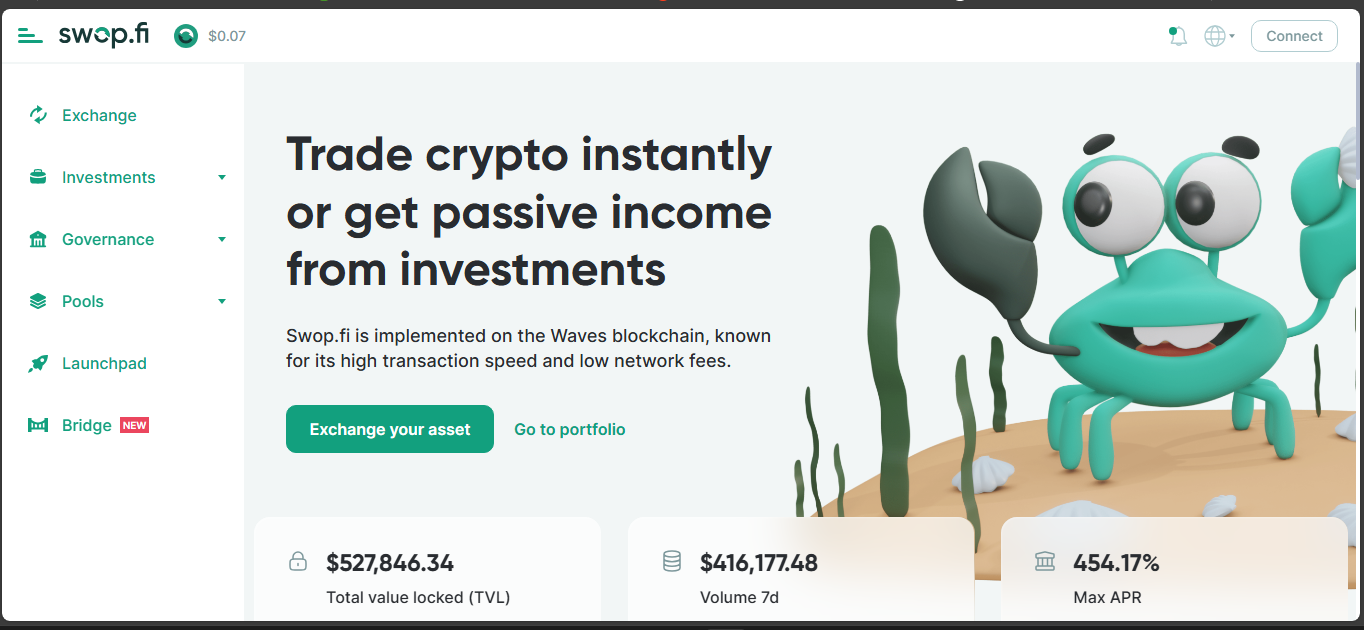

Swop.fi is built on the Waves blockchain, meaning lightning-fast confirmations and minimal fees – just 0.005 WAVES per swap, mere cents in cost. It stands out as an AMM crafted for flexibility – different pricing formulas for different token pair types. Stablecoin pairs use a flat formula to reduce slippage, while other pairs default to the constant-product model familiar in DeFi.

Liquidity & Rewards

Anyone can deposit into liquidity pools. The pools earn from trading fees – 0.3 percent for most swaps, with reduced fees (around 0.05 percent) for stablecoin pairs like USDT-USDN. Some of that income gets converted into SWOP tokens and distributed to liquidity providers, alongside fee shares. Overall, LPs can expect total returns ranging between 5 percent and as much as 50 percent APY, combining yield and protocol incentives.

Market Activity & Token Stats

On-chain metrics show that Swop.fi’s 24-hour DEX volume is currently negligible – essentially zero – meaning it’s not seeing active trade flows.

The native SWOP token trades at around 0.09 dollars, with a market cap near 366,000, circulating supply just under 4 million out of a 6 million max. Daily volume hovers around 20,000 dollars – small scale, but not unheard of for niche utility tokens.

Governance & Decentralization

As a DeFi protocol, Swop.fi aligns with open-source, non-custodial principles. There’s no central authority – swaps go directly between wallets, and staking and governance happen on-chain. The SWOP token unlocks governance access, letting users shape certain protocol choices via staked rewards and voting.

Monetization & Ecosystem Economics

Metrics via DeFi analytics show the current Total Value Locked (TVL) is around 1.6 million dollars, with fees collected over time reaching into the tens of thousands, and modest revenue flows. Swap fee structure generally sits at 0.6 percent for volatile pools and 0.15 percent for stable pairs, with governance staking discount tiers between 5 percent and 35 percent.

Strengths & Weaknesses Snapshot

Strengths:

- Ultra-low fees and fast swaps via Waves blockchain

- Tailored AMM formulas minimize slippage across pair types

- Potentially high yields via token rewards + fees

- Non-custodial and open-source – aligns with DeFi ideals

Weaknesses:

- Very low trading volume – little liquidity, limited depth

- Token and yield economics unclear – risk of mispriced incentives

- Governance is nascent – real influence may be limited

- No centralized support or visibility – user support likely minimal

Who Should Care

If you’re an early-stage DeFi adopter or Waves ecosystem explorer, Swop.fi might interest you. It offers a playground for staking, experimenting with LP strategies, and engaging with on-chain governance. For broader traders seeking volume, reliable liquidity, or polished interfaces, it remains too experimental and underserviced.

Conclusion

Swop.fi is a lean, efficient AMM built for the Waves chain – from fee structure to formula design, everything is optimized for minimal friction. Its yield potential via SWOP rewards is appealing, but only if you’re comfortable in a micro-scale DeFi environment. Think of it as a sandbox for DeFi natives and early-movers – a quiet corner of experimentation rather than a bustling market.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”