Uniswap – Exchange Review

Introduction

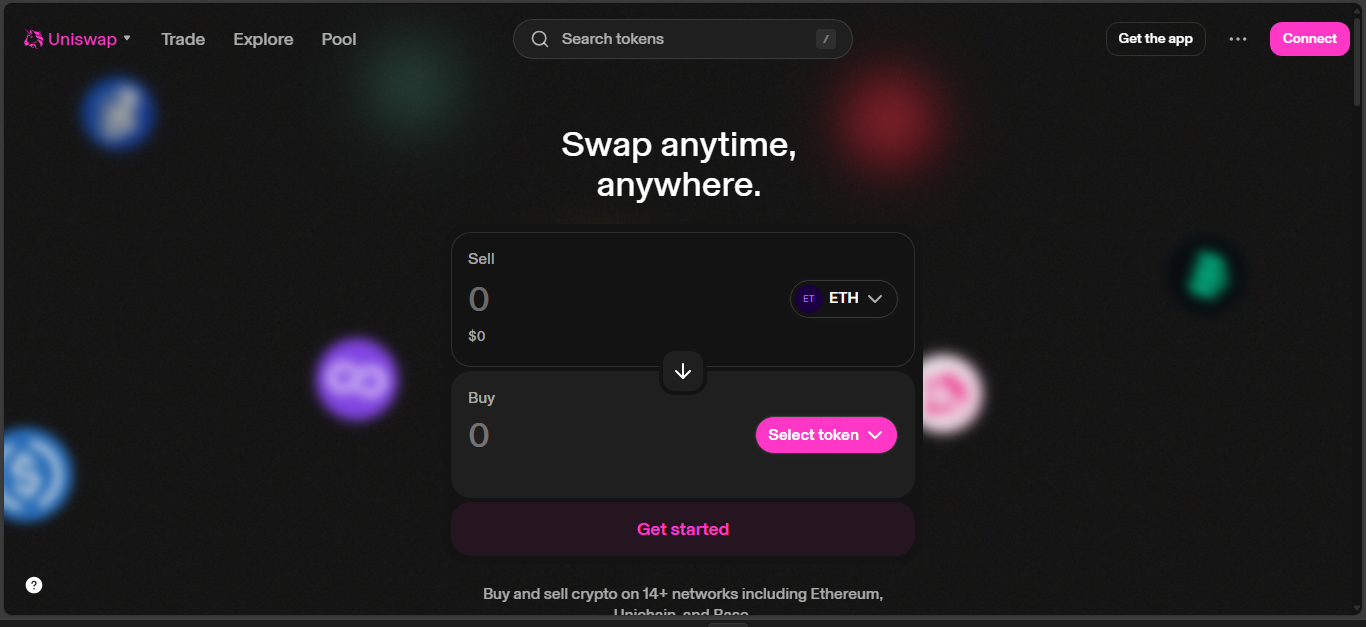

Uniswap is the protocol that pushed decentralized exchanges into the mainstream. Since 2018, it has offered a way to trade tokens without centralized order books. The idea was radical yet simple – liquidity itself became the market. That principle made DeFi both accessible and explosive.

How It Works

At its core, Uniswap runs on the automated market maker model. Liquidity providers add equal values of two tokens into a pool. The smart contract ensures the balance with the constant product formula. Every trade shifts the ratio, adjusting prices naturally. No intermediaries, no order books – just math and liquidity. For traders, it means instant on-chain swaps. For providers, it means earning a slice of every transaction.

Evolution of the Protocol

Uniswap has reinvented itself with each version.

- V2 enabled direct ERC-20 to ERC-20 swaps and expanded pair options.

- V3 brought concentrated liquidity, letting providers focus their capital on tighter price ranges. Fee tiers of 0.05, 0.30, and 1 percent gave strategies more precision.

- V4 is the newest step, introducing hooks – pieces of custom logic that can modify how pools behave. Developers can build features like dynamic fees or auto-rebalancing strategies right into the protocol.

This constant upgrade cycle keeps Uniswap ahead of rivals and ensures its relevance.

Position in the Market

By mid-2025, Uniswap has surpassed three trillion dollars in total swap volume. Daily activity often crosses three billion, making it the single largest decentralized exchange by share. V4 already commands over 30 percent of platform volume, and in July alone it processed more than 100 billion in trades. That scale gives Uniswap both weight and influence in the DeFi ecosystem.

Why It Matters

Uniswap is more than just a trading venue. It embodies permissionless finance. No KYC, no gatekeepers – only a wallet and gas fees. Any ERC-20 token can find liquidity here. For developers, it is a sandbox. For traders, it is instant access. For liquidity providers, it is yield. And for UNI holders, it is governance. That combination of utility and community explains its staying power.

Risks and Limitations

Decentralization carries trade-offs.

- Scams: Anyone can list a token. This openness has led to countless honeypots and rug pulls.

- Costs: Gas fees on Ethereum spike during peak demand, making trades expensive.

- Slippage: Large swaps can move prices unfavorably.

- MEV: Bots exploit transaction order, extracting value from users.

- Fragility: Liquidity is concentrated in a few pools. If those falter, the broader network shakes.

These risks don’t erase its value, but they highlight why caution is needed.

Governance and UNI Token

In 2020, the UNI token launched to decentralize decision-making. Holders propose and vote on changes, shaping fee models, chain expansions, and protocol upgrades. Yet power is not evenly spread. Whales and funds with massive UNI holdings can tilt outcomes. Despite that imbalance, governance has been active and continues to chart Uniswap’s growth path.

Strengths & Weaknesses at a Glance

Before wrapping up, here is a quick balance sheet of Uniswap’s profile:

Strengths:

- Massive liquidity and unmatched volumes

- Permissionless access without barriers

- Innovative protocol with constant upgrades

- Strong developer adoption and ecosystem support

- Global reputation as the top DEX

Weaknesses:

- Exposure to scam tokens and honeypots

- High gas fees during congestion

- Slippage and MEV risks for big traders

- Governance leaning toward large UNI holders

Conclusion

Uniswap is not just another exchange – it is the blueprint of DeFi. It blends openness, scale, and innovation in a way few rivals can match. The protocol is fast-moving, powerful, and risky at times, but always central to the conversation. For traders, liquidity providers, and developers, Uniswap is both a gateway and a benchmark. In 2025, it remains what it has been from the start – the heart of decentralized trading.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”