Uniswap V2 – Exchange review

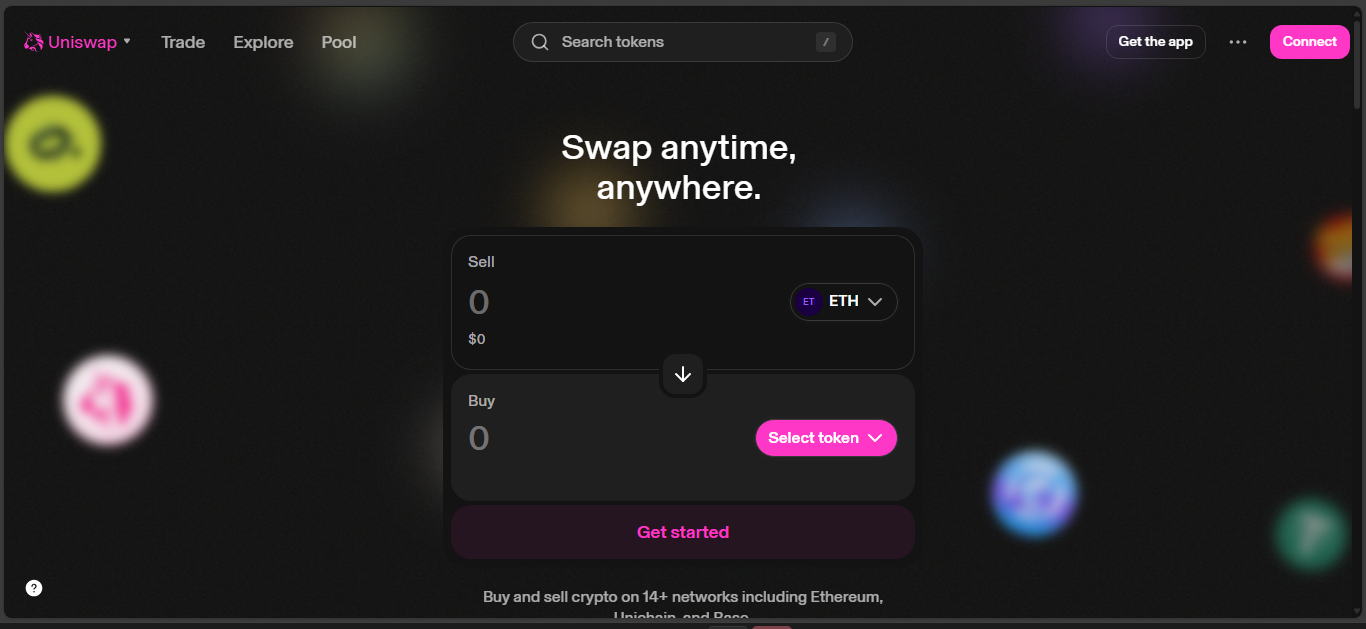

Uniswap V2 came out in 2020. It changed how folks trade tokens. Before that, you mostly needed a regular exchange with order books or slow OTC stuff. V2 let you swap straight from your wallet. No middlemen, no signup, just connect and trade.

It used simple liquidity pools. Two tokens sit there. Anyone can trade against the pool. Anyone can also drop in liquidity and earn fees. That’s it. It’s not complicated, and that’s why it took off.

Why It Was Such A Big Deal

Suddenly you could trade almost any ERC-20 for another. Didn’t matter if it was big like ETH or some tiny new token. If someone made a pool, you could swap. That’s why DeFi blew up. People could ape into new coins without waiting on big exchanges to list them.

It also meant yield farming exploded. Projects would say, “put your tokens in Uniswap, get our bonus token too.” So tons of folks added liquidity just for rewards, not even caring about swap fees.

How The System Worked

It ran on a simple formula. Constant product: x*y=k. Pools kept the balance. If someone bought a lot of token A, the price of A would go up. Fees were 0.3% per trade. Those went to liquidity providers.

LPs could pull out anytime. The risk was impermanent loss. If one token moons or dumps, you might end up with less than just holding. But many chased fees and didn’t care.

It also had flash swaps. That let you borrow tokens with no upfront money, as long as you returned them in the same transaction. That was huge for bots, arbitrage, and fancy DeFi tricks.

What Made V2 Better Than V1

V2 added a few key things. You could pair any token with any token. Didn’t have to route everything through ETH. That saved gas and made big trades simpler.

It also added a better price oracle built into the pools. Smart contracts could check average prices over time, not just one block. That stopped some front-running attacks and made lending protocols safer when using Uniswap prices.

Flash swaps were new too. People could build more complicated stuff, like borrowing a ton of one token, swapping, paying it back – all in one shot.

Why People Liked It

- Anyone could add liquidity and earn.

- No asking permission or opening accounts.

- New tokens launched there first.

- Bots and advanced traders loved flash swaps.

- Price feeds got safer.

But Not All Was Great

Fixed fees meant pools with stablecoins or blue chips couldn’t lower rates to compete. Everything was 0.3%, even if it didn’t need to be.

Impermanent loss stayed a big problem. If you held ETH and DAI in a pool, and ETH took off, you’d end up with more DAI and less ETH than just holding. Some people underestimated how bad that could get.

Gas fees also sucked. During busy times, swapping cost a fortune. Failed transactions burned money too. That’s still Ethereum’s pain point.

Who Used It Most

- Yield farmers who stacked tokens and got bonus coins.

- Small projects wanting instant liquidity for their new coin.

- Bots that did arbitrage or liquidations.

- Regular people who liked trading without KYC.

Who Should Be Careful

If you hate paying $20+ for a transaction, that’s a problem. If you’re scared of impermanent loss, adding liquidity isn’t smart. Also, there’s no customer support – you mess up, it’s on you.

Short Pros & Cons

Pros

- Trade almost any token, no account needed

- Anyone can provide liquidity and get fees

- Open, transparent – you see pools on-chain

- Flash swaps power lots of cool DeFi stuff

Cons

- Impermanent loss can wreck your portfolio

- Fees stuck at 0.3%, even for stable pairs

- Gas fees on Ethereum can kill small trades

- No insurance if a bug drains your pool

Final Word

Uniswap V2 wasn’t flashy – it just did its job. But that simple system totally changed crypto. It showed you didn’t need banks or big exchanges to swap assets. It let new projects launch instantly. It let LPs become the market makers.

Sure, it had flaws. Fees couldn’t adapt. Gas was brutal. But V2 kicked off a whole new world. Even now, tons of smaller trades still run through it because it’s stable and battle-tested.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”