Uniswap V3 on Polygon – DEX Review

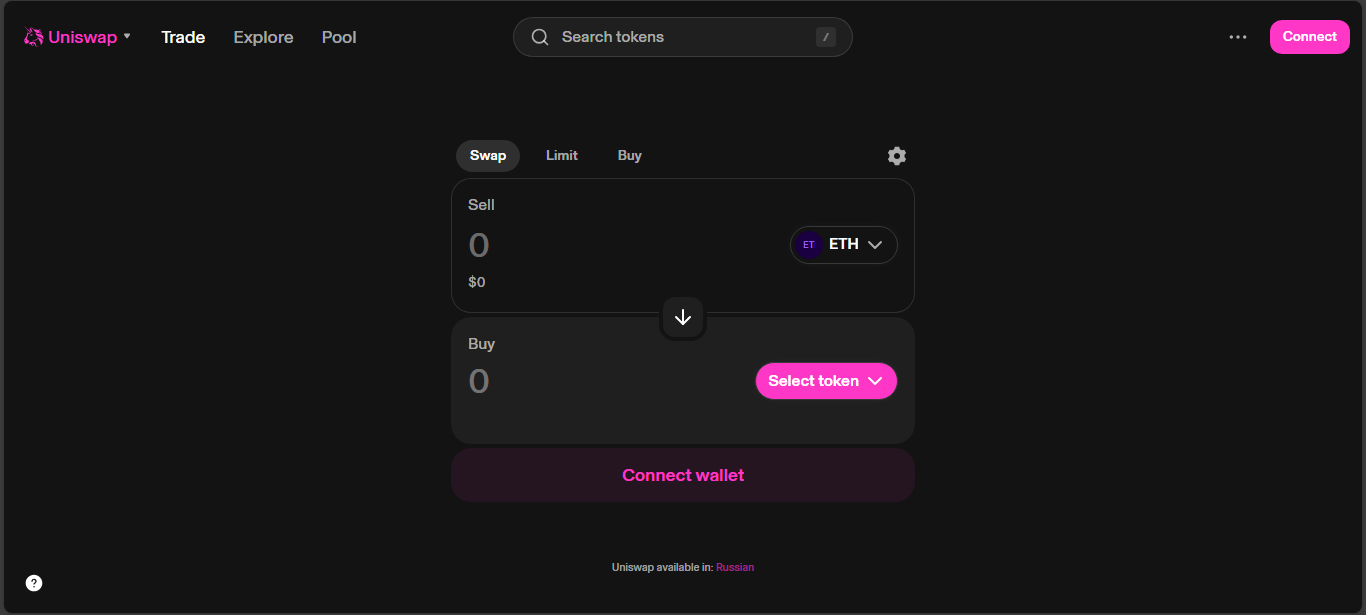

First impressions

Uniswap V3 on Polygon brings the V3 capital-efficient AMM model to a fast, low-cost chain. It’s built for serious users – offering granular control without fluff.

What it actually offers

The protocol implements concentrated liquidity across custom price ranges and tiered fees. Liquidity providers choose their bands to deploy capital more efficiently, though that requires active range management. The UI integrates position NFTs, fee tiers, range editing, and smart swap routing.

Volume and liquidity signals

24-hour trading volume typically sits around USD 50-65 million and includes hundreds of tokens across hundreds of pairs; major pools like USDC-USDT see the highest activity. With daily volumes in the tens of millions, it’s strong for mid-tier activity on Polygon.

Fees and capital efficiency

LPs pick from three fee tiers – 0.05 percent for stablepairs, 0.3 percent for standard pairs, and 1 percent for volatile tokens. Tighter ranges boost returns but increase risk if prices move out of band.

Security and audits

Uniswap V3 smart contracts were audited at launch and have proven reliable with no major exploits. The Polygon deployment mirrors the audited Ethereum code. Risks lie mostly in LP mismanagement, not protocol flaws.

User experience and tools

The interface is familiar – range sliders, NFT position tokens, fee tier selection, and routing. Polygon’s fast block times and low gas costs make UX smooth. External tools help monitor positions and adjust ranges.

What makes it unique

This DEX combines:

- V3 capital efficiency via concentrated liquidity

- Polygon’s low gas and fast finality

- Broad token support from stablecoins to emerging assets

No layers of bells and whistles – just depth and control.

Strengths and weaknesses

Strengths:

- Capital-efficient design with concentrated liquidity

- Tiered fees tailored to volatility

- Daily volume in the tens of millions with wide token selection

- Proven, audited protocol on a low-cost chain

Weaknesses:

- Requires active LP management to avoid inefficiency

- Impermanent loss if price exits your range

- Can overwhelm newcomers with complexity

- No fiat, no staking, no governance tools beyond UNI

Who it suits

Uniswap V3 on Polygon is ideal for:

- Experienced LPs optimizing capital use

- Traders needing liquid mid-sized swaps without high slippage

- Users who want fast, cheap token swaps on Polygon

It’s less fit for:

- Beginners looking for simple one-click swaps

- Passive LPs uninterested in managing ranges

- Users needing fiat ramps or cross-chain integration

Final thoughts

Uniswap V3 on Polygon delivers power, precision, and efficiency. With audited contracts, solid volume, and cost-effective execution, it’s among the top capital-efficient DEXes available. But it demands attention and knowledge – range strategies aren’t beginner-friendly.

If you seek control and yield, this is where pros set up. If you want simplicity, other platforms on Polygon may be easier – but none match V3 for optimized liquidity.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”