Uniswap V3 (Polygon) – Exchange Review

Fast Intro

Uniswap V3 hit Polygon in November 2021 – the same AMM everyone knows, but now on a cheaper, faster sidechain. If you’ve used Uniswap V3 on Ethereum, this feels like familiar gear – just lighter, quicker, and cheaper.

What It Brings

Concentrated liquidity, custom price ranges, capital efficiency – same V3 mechanics. But now, gas costs are tiny, swaps rarely cost more than dust. Liquidity providers can dial in tight ranges and squeeze more from every MATIC used.

Why It’s Useful

Polygon fixes two big headaches: speed and cost. V3 on Ethereum feels smooth until you check gas. On Polygon it’s fast, cheap, and V3’s efficiency kicks hard. That draws both everyday users and LPs running tight strategies.

Numbers at a Glance

24h volume sits around $45 million – not a flash, but solid and active.

Token count: about 214. Pairs: near 489. That shows range – not just big caps, but niche projects too.

Fee tiers still apply: stable-pair pools at 0.05%, normal ones at 0.3% or 1%.

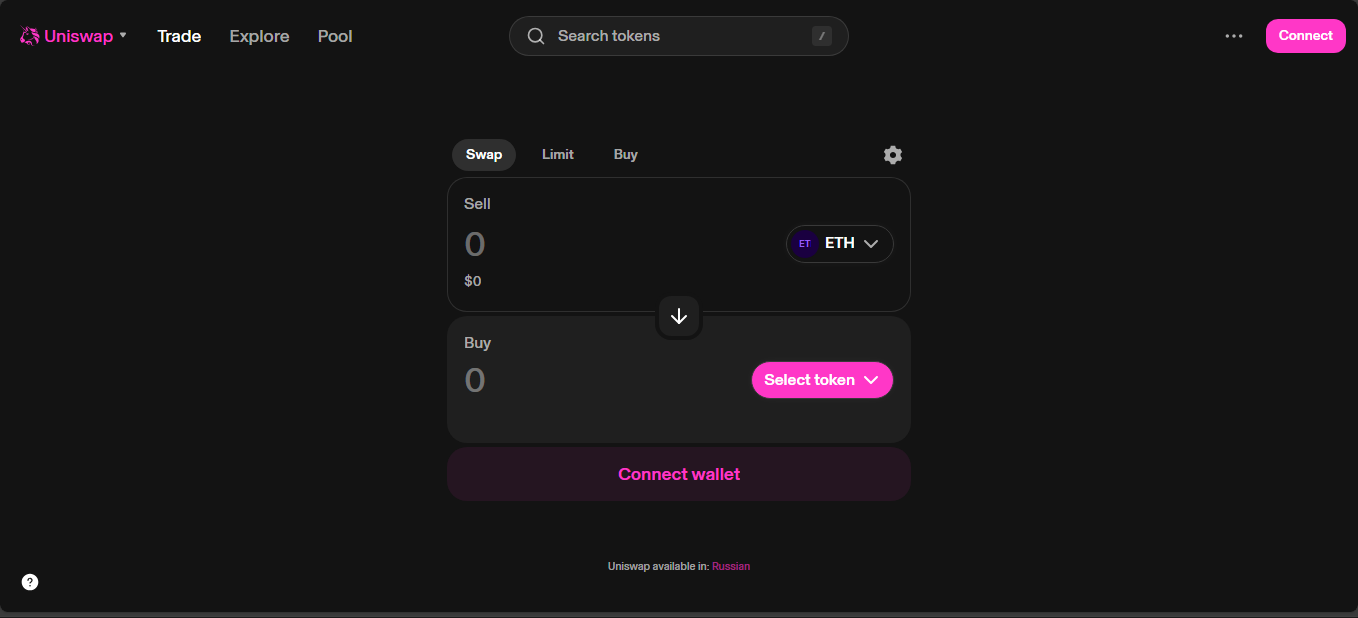

User Feel

Use it and it feels just like generic Uniswap – swap box center stage, charts where they should be, liquidity options clear. It’s minimal. It’s familiar. It doesn’t crash. You don’t worry about MATIC gas eating your trade.

Upsides & Downsides

Upsides

- Low gas and fast speed – Polygon advantage

- V3 mechanics keep capital efficient

- Active volume – $45M+ daily

- Broad token catalog – 200+ tokens, 400+ pairs

Downsides

- Still decentralized – no fiat, no support

- Liquidity fragmented across pools

- Too many fee options can confuse beginners

- Some niche pools thin – depth varies

How It Works

You deposit tokens into a V3 pool, set a range, and wait. Liquidity sits there. Swaps show price curves and slippage before you hit confirm. Fees vary by pool type – stable vs volatile. Everything moves fast. Everything feels tight.

Present-Day Pulse

As of 2025, V3 on Polygon runs steady. Volume consistent. Liquidity deep on big pairs, thinner on smaller ones. Network stays cheap. Activity spreads across categories – stablecoins, wrapped ETH, niche tokens too.

Lessons from It

Layer-2 plus V3 mechanics equals efficiency. Experts get more yield, users get lower cost. But usability still basic – no fiat, no margin. It’s raw DeFi. That’s its appeal, and its limitation.

Final Word

Uniswap V3 on Polygon is the workhorse – not flashy, but efficient and alive. Capital efficiency meets cheap, fast swaps. For DeFi users it’s essential. For casuals, it’s usable if you know what you’re doing. Quietly powering volume on the backbone of cleaner DeFi.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”