Vertex Protocol – Exchange Review

Snapshot – At a Glance

Vertex Protocol isn’t bullhorn loud – it’s lean, technical, efficient. It delivers features of a CEX wrapped in DeFi DNA, quietly fueling traders with speed and capital fluidity.

| Feature | Details |

| Launch Date | April 2023 on Arbitrum |

| Model | Hybrid orderbook + AMM |

| Markets | Spot, perpetuals, money markets with unified cross-margin |

| Speed | 15–30 ms latency – CEX level |

| Fees | Maker ≈ 0%, Taker ≈ 0.02–0.04% |

| Token | VRTX – staking, governance, voVRTX score-based rewards |

| Founded By | Darius Tabatabai & Alwin Peng |

| Supply Cap | 1 billion VRTX; ~528 million circulating |

Origins and Mission

Vertex came alive in the spring of 2023, seeded by a trader-tech duo. Their goal was to fuse the mechanics of centralized trading – speed, liquidity, precision – with the freedom and transparency of DeFi. Spot, perps, money markets, a cross-margin engine – all integrated. No custody, just control

Core Strengths

Vertex delivers CEX-speed in DeFi skin. The hybrid design means deep liquidity and smart order matching. Trades happen fast via an off-chain sequencer – MEV and gas stay muted. Fees remain ultra-lean. VRTX holders stake, earn, and build legitimacy with voVRTX scores tied to long-term participation.

Risks and Realities

This powerhouse is not bulletproof. Volume can be volatile – burns and rewards shrink on slow days. The DAO is active, but whales might steer votes. Token supply is massive – even burns won’t make VRTX scarce quickly. The ecosystem is still Arbitrum-heavy – cross-chain ambitions are there, but adoption remains niche.

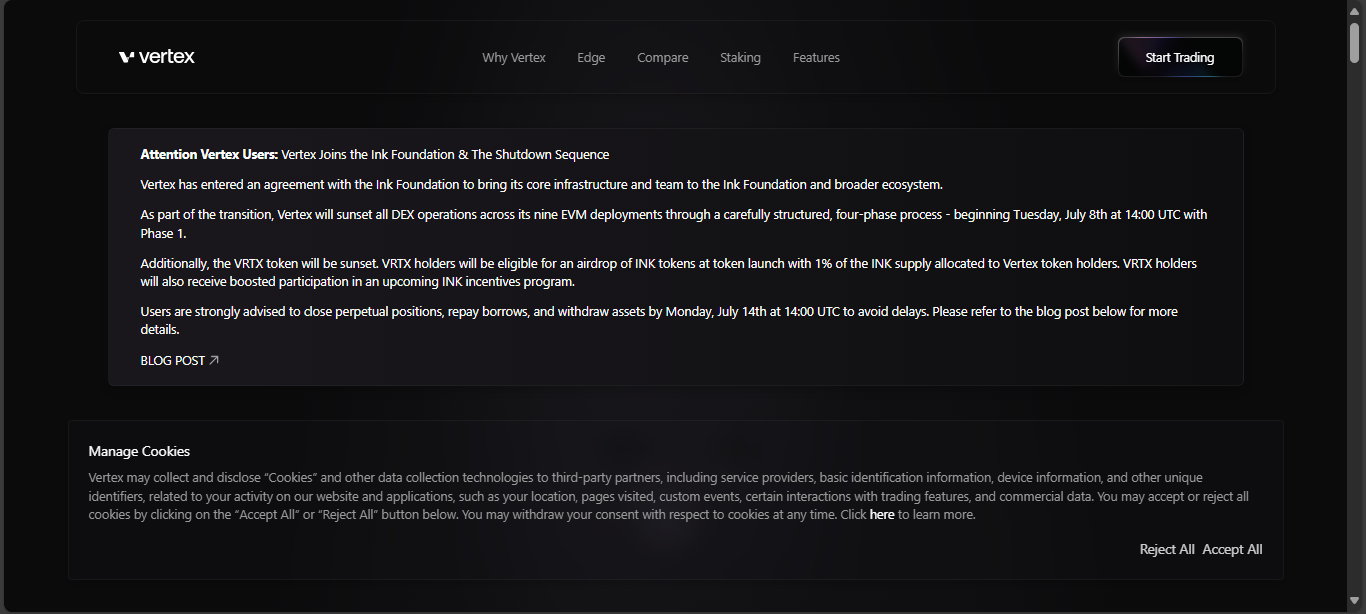

Shutdown Transition

Change is underway. As of July 2025, Vertex began a phased shutdown across its deployments – partnering with Ink Foundation. VRTX is being sunset, replaced through INK airdrops. The move reflects harsh DeFi realities – not all giants survive. Users must withdraw assets quickly to avoid being stuck in the herd.

Final Thoughts

Why Vertex Protocol earned its place

- Best-of-both-worlds trading tech: CEX speed meets DeFi control

- Clever tokenomics with staking and rewards baked in

- Highly functional interface for pro traders on Arbitrum

Why caution is still due

- Governance concentration is a risk

- No guarantee of VRTX value post-shutdown

- Transition to Ink Foundation leaves uncertainty on road ahead

Vertex was a precision-built beast of a DEX – fast, sharp, integrated. And now it is evolving – a reminder that DeFi is fast-moving, ruthless, and always shifting.

Disclaimer

“This content is for informational purposes only and does not constitute financial advice. Please do your own research before investing.”